Should taxes pay for private schools?

Public money for private and religious schools

Should taxpayers foot the bill for private and religious schools? Voters will again face this question on the ballot in 2022, if either or both of two campaigns raise enough money to collect a million signatures in the next few months.

Today, the California constitution prohibits the use of public funds — that is, taxes — to pay for religious and private schools. Some private school advocates aim to change this.

California voters have twice rejected ballot proposals that would amend the state constitution, remove the separation of church and state in education, and redirect tax funding to private school tuitions. Some private school boosters are betting that COVID-weary voters are angry enough to make the outcome different in 2022. Signature-gathering businesses are now hiring workers to work the streets with clipboards for two competing voucher-like initiatives that would amend the state constitution.

This is a big-money bet. To place a constitutional amendment on the ballot will require about a million signatures, at an average cost projected to be in the neighborhood of $10 each. Signatures must be collected quickly and confirmed by the end of April.

Vouchers, a.k.a Education Savings Accounts, or Scholarships

In California, past unsuccessful ballot measures to direct taxes toward private education were promoted as voucher programs. It’s a politically tainted term in California politics, so the proponents call them something else: Education Savings Accounts. This year’s proposals do the same thing as vouchers or tax-funded scholarships, though: they divert public money to pay private and religious schools.

Using a different name does not magically change its impact. If it looks like a duck, swims like a duck, and quacks like a duck, then it’s probably a voucher.

Both of these constitutional initiative amendments propose massive changes in the way children are educated. In both, public funds can be used to pay for the costs of private and religious schools as well as for homeschooling.

|

The competing voucher measures |

|

|---|---|

|

The Educational Freedom Act would pay $14,000 per year toward private tuition and education expenses, a figure to be adjusted annually. (See Attorney General Analysis 21-0006A1) |

The Education Savings Account Act would pay $13,000, also adjusted annually. (See Attorney General Analysis 21-0011A1) |

Existing private and religious schools would be big winners under either of these competing initiatives, which would shift private school expenses to taxpayers. According to the state Attorney General, the cost to taxpayers would be in the range of $4 billion to $7 billion for students currently enrolled in private school and homeschools. Yup, you read that correctly: billions to pay for students currently enrolled in private or home school.

Under both proposals, the state would create an educational savings account for participating students, used to pay for private tuition and other approved education expenses. The amounts in the accounts are roughly what the state pays for the average student in public school, but far less than what it costs to educate students with special needs or who are learning English. Neither proposal would follow the example of California’s current education funding laws, which direct funding in support of students with higher needs through the Local Control Funding Formula.

History of school vouchers

Let’s back up a bit. These initiatives propose not just a significant change in how California funds education, but a massive change in the relationship between government and religion. Since the adoption of the Bill of Rights, a fundamental principle of American governance has been a “wall of separation between church and state,” as proclaimed by Thomas Jefferson.

The first amendment of the US Constitution says:

“Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof.”

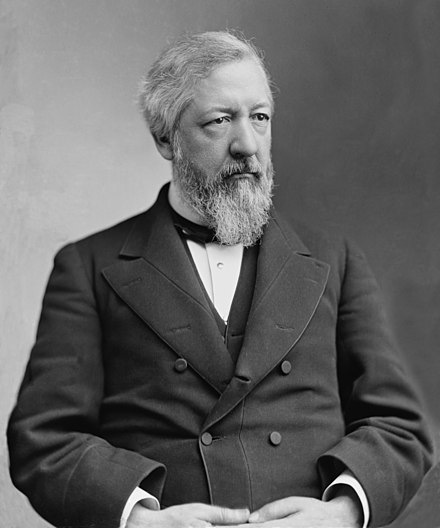

James G. Blaine

To clarify that state governments could not fund religious education, in 1875 Congressman James G. Blaine proposed an amendment to the U.S. Constitution to prohibit state governments from, among other things, subsidizing religious schools with public money. The amendment was not ratified as part of the US Constitution, but Blaine amendments were adopted in the constitutions of 38 states, including California. It’s in Article XVI, Section 5:

Neither the Legislature, nor any county, city and county, township, school district, or other municipal corporation, shall ever make an appropriation, or pay from any public fund whatever, or grant anything to or in aid of any religious sect, church, creed, or sectarian purpose, or help to support or sustain any school, college, university, hospital, or other institution controlled by any religious creed, church, or sectarian denomination whatever;…

The sordid history of education voucher programs can be traced to the 1954 Brown v. Board of Education decision, which required desegregation of public schools. The desegregation order triggered a wave of white flight to private schools, which were not subject to the ruling. To skirt the law, some southern states began issuing tax-funded tuition vouchers, which were accepted at private segregated schools.

Expansion of school voucher programs was a policy priority of former US Secretary of Education Betsy DeVos, who advocated for the repeal of Blaine amendments. She argued that separation of church and state in education limits parents’ freedom to decide what is best for their children and violates the free exercise of religion. Today, tax-funded voucher programs (or the equivalent) exist in places in 16 states, according to the Education Commission of the States. Florida and Washington, D.C. have widely noted systems, but according to EdChoice.org, the state that subsidizes private school tuition most is Illinois, where private school tuition is tax-deductible.

Many school voucher proposals have been blocked as unconstitutional, but there are signs of change. Recent deliberations of the US Supreme Court suggest that some justices might be receptive to arguments in favor of more state funding of religious schools.

How do initiatives get on the ballot?

These initiatives won’t necessarily make it to the ballot in California, but they might. Here’s how the process works.

Before an initiative can be circulated for signatures, it must go through a registration and review process by the Attorney General and the state Legislative Analyst. This part of the process has been completed for both measures.

Once that process is finished, signature gathering takes place. Proponents are allowed 180 days from the official summary date to circulate petitions, collect signatures, and file petitions with county elections officials. Both of these constitutional amendment initiatives are now gathering signatures. The number of required valid signatures this year is 997,139.

For more details, read the Secretary of State’s 52-page explainer How to Qualify an Initiative.

Third Time a Charm?

California voters resoundingly defeated voucher initiatives twice, in 1993 and 2000. Partly in response to these campaigns, California education policy now incorporates greater school choice, including a robust public charter school system as well as choice within local school assignment systems. How have the circumstances changed?

Voucher-like initiatives on the ballot this year can capitalize on the anxiety and anger triggered by pandemic disruptions to education. The arguments mirror deep conflicts playing out in the pandemic: personal choice and freedom versus benefits to society as a whole.

Here are issues that were not on the table when vouchers were last voted on in California:

New(ish) issues related to vouchers |

|

|---|---|

|

Pandemic disruptions to schools |

Will the pandemic-created disruptions to education convince voters it's ok to take funding away from public schools to pay tuition at private and religious schools? |

|

Free choice vs the public good |

Will voters who want to exercise freedom of choice over masks and vaccinations and curriculum transfer that political viewpoint to support more school choice? |

|

Political polarization regarding race, faith and history |

How will the political activity supporting and opposing white christian supremacy impact voter decisions on voucher initiatives that provide for faith-based curriculum? |

|

Parents ignored |

Will parents who feel their voices were not heard about closing public schools during the pandemic abandon public education for private and religious schools? |

|

Income inequality |

How will those who call for more equitable public policy react to a voucher that pays for wealthy students to attend super expensive private schools? |

|

Private schools get to choose their students |

Will voters support public money for private and religious schools that can pick and choose which kids they want to accept? |

|

Transparency and accountability |

Will voters support public money for private and religious schools that have far less transparency and accountability than charter schools and traditional public schools? |

|

Private school costs |

Will voters support initiatives that financially limit choice to mostly religious schools? |

Even though parents are frustrated about their schools, most voters have not lost all faith in them. An April 2021 survey by the Public Policy Institute of California (PPIC) provides some clues: (1) Strong majorities approve of their district’s handling of school closure. (2) Most give their local schools good grades, but a growing share would opt for private school.

Would they be better off?

Are private schools better?

A core argument of the campaigns for voucher systems is that public schools are terrible and that moving lots of kids to private schools would produce better results at lower cost. This falls squarely in the “blow it up to fix it” tradition of change management.

There have been many studies of voucher programs, often sponsored by religious orders or pro-voucher organizations. Early small-scale experimental programs seemed to suggest almost miraculous results, but those findings have not survived broader examination. More recent studies indicate that vouchers for private schools are not a silver bullet. Most research about them suffers from a bad case of selection bias.

“It’s true that children with a history of enrollment in private schools perform better on nearly all outcomes assessed in adolescence. However, by simply controlling for the sociodemographic characteristics that selected children and families into these schools, all of the advantages of private school education were eliminated. There was also no evidence to suggest that low-income children or children enrolled in urban schools benefited more from private school enrollment.”

— “Does Attendance in Private Schools Predict Student Outcomes at Age 15? Evidence From a Longitudinal Study” Robert C. Pianta, Arya Ansari

The Learning Policy Institute report Creating Quality School Choices for All America's Children concludes that the “evidence shows that simply providing choices does not automatically provide high-quality options that are accessible to all students or improve student learning.”

According to a report by Stanford Graduate School of Education (GSE) Professor Martin Carnoy: “Evidence is very weak that vouchers produce significant gains in learning. They also carry hidden costs, and they’re distracting us from other solutions.”

“There are many policy changes that are likely to have much higher payoffs than privatization,” said Carnoy, “including teacher training, early childhood education, after-school and summer programs, student health programs and heightened standards in math, reading and science curricula.”

The reputation fallacy

If all of that is true, why do private schools seem to have stronger reputations than public schools? When thinking systemically about private and public education, it’s important to remember the crucial differences in context that contribute to the differences in reputation between them.

Because private school families pay to send their kids to school, they have a vested interest in saying and believing good things about their school, especially in comparison with other schools. Private schools invest significantly in managing their reputation, and there is little incentive to say bad things in public. Private school boards meet in private, with disputes or errors handled as quietly as possible. Measurable results like test scores don’t have to be made public, so schools are selective about it. They are free to accentuate the positive, eliminate the negative, and not mess with mister in-between. Also, private schools only serve students that they choose.

Public schools, by contrast, serve all students. They are governed by board members who might not agree with one another. They meet in a fishbowl, and reach decisions under constant scrutiny and criticism. Every time there is a competitive school board election, criticism is part of the process. Results are public, including both the good and the bad, but the human tendency toward negativity bias causes the bad news to “stick” more than good news.

Proposed Voucher Initiatives

Selected differences and similarities

|

|

|

|

|---|---|---|

|

Proponents’ title and key links |

Educational Freedom Act of 2022 1900. (21-0006A1) Requires state funding of religious and other private school education. Initiative constitutional amendment and statute. How this campaign compares itself with the competing measure |

Education Savings Account Act of 2022 1905. (21-0011A1) Requires state funding of religious and other private school education. Initiative constitutional amendment and statute. How this campaign compares itself with the competing measure |

|

Funding |

Requires the state to provide yearly voucher payments ($14,000 initially, adjusted annually) into Education Savings Accounts for K-12 students attending religious and other private schools. |

Requires state to provide yearly voucher payments ($13,000 initially, adjusted annually) into Education Savings Accounts for K-12 students attending religious and other private schools Children from low to medium-income families get initial access in the first four years. |

|

Home school |

A student enrolled in an eligible private school to facilitate homeschooling is eligible. |

|

|

Post secondary education expense |

Funds remaining in the student’s ESA can be used for qualified education expenses until the age of 30. |

Up to $60,000 of leftover funds can be saved for college. |

|

Accountability and admission |

Prevents the state from requiring these schools to meet certain requirements. The state could not require participating schools to modify their admission policies, change their curriculum, or require their students to participate in statewide tests. The measure would not change the state's ability to adopt laws that would apply to all private schools regardless of their participation in the program. |

|

|

Annual costs |

Increased annual state costs, probably in the range of $4.7 billion to $7 billion, to provide state funding for students currently enrolled in private school or homeschool. |

Increased annual state costs, likely growing to $4 billion to $6 billion by the end of the five-year implementation period, to provide state funding for students currently enrolled in private school. |

|

Costs of children moving from public school to private school |

Increased annual state costs, probably at least several billion dollars, to the extent students move from public to private schools. |

|

|

Reduced state costs |

Lower spending on public schools would roughly offset these costs. Likely reduced state costs for school bonds, potentially reaching a couple hundred million dollars annually within the next few decades. |

|

|

Circulation deadlines |

April 11, 2022 |

April 26, 2022 |

Private, religious, and home schools in California

Wondering how many students attend private and religious schools in California and what they cost? We’ve got answers.

Private school enrollment. Less than a tenth of California students attend a private school. In the current school year (2021-22) there are 436,854 students enrolled in private schools in California according to public affidavits filed by the schools. A bit more than a third of these students attend Catholic schools, and a bit less than a third attend non-religious schools. The balance attend schools affiliated with a variety of religions and sects.

Private school costs. True tuition and other costs of private school are not public, but Private School Review, a publication that follows the industry, makes estimates.

Average cost of private school in California, 2021 |

|||

|---|---|---|---|

|

|

Elementary school |

High school |

Average |

|

All private schools |

$14,537 |

$21,019 |

$15,437 |

At each education level, the cost of tuition at private schools with a religious affiliation tends to be lower than those without an affiliation. Based on this data, neither of the proposed initiatives would fully cover the average tuition cost of a private school education in California, especially in high schools. For example, tuition at St. Ignatius College Prep in San Francisco for the academic year 2021-2022 is $28,455 per student.

Learn more about how private schools fit in California's education system in Ed100 Lesson 5.6

Tags on this post

History Home schools Private schools Purpose of education Universal educationAll Tags

A-G requirements Absences Accountability Accreditation Achievement gap Administrators After school Algebra API Arts Assessment At-risk students Attendance Beacon links Bilingual education Bonds Brain Brown Act Budgets Bullying Burbank Business Career Carol Dweck Categorical funds Certification CHAMP Change Character Education Chart Charter schools Civics Class size CMOs Collective bargaining College Common core Community schools Contest Continuous Improvement Cost of education Counselors Creativity Crossword CSBA CTA Dashboard Data Dialogue District boundaries Districts Diversity Drawing DREAM Act Dyslexia EACH Early childhood Economic growth EdPrezi EdSource EdTech Effort Election English learners Equity ESSA Ethnic studies Ethnic studies Evaluation rubric Expanded Learning Facilities Fake News Federal Federal policy Funding Gifted Graduation rates Grit Health Help Wanted History Home schools Homeless students Homework Hours of opportunity Humanities Independence Day Indignation Infrastructure Initiatives International Jargon Khan Academy Kindergarten LCAP LCFF Leaderboard Leadership Learning Litigation Lobbyists Local control Local funding Local governance Lottery Magnet schools Map Math Media Mental Health Mindfulness Mindset Myth Myths NAEP National comparisons NCLB Nutrition Pandemic Parcel taxes Parent Engagement Parent Leader Guide Parents peanut butter Pedagogy Pensions personalized Philanthropy PISA Planning Policy Politics population Poverty Preschool Prezi Private schools Prize Project-based learning Prop 13 Prop 98 Property taxes PTA Purpose of education puzzle Quality Race Rating Schools Reading Recruiting teachers Reform Research Retaining teachers Rigor School board School choice School Climate School Closures Science Serrano vs Priest Sex Ed Site Map Sleep Social-emotional learning Song Special ed Spending SPSA Standards Strike STRS Student motivation Student voice Success Suicide Summer Superintendent Suspensions Talent Teacher pay Teacher shortage Teachers Technology Technology in education Template Test scores Tests Time in school Time on task Trump Undocumented Unions Universal education Vaccination Values Vaping Video Volunteering Volunteers Vote Vouchers Winners Year in ReviewSharing is caring!

Password Reset

Search all lesson and blog content here.

Login with Email

We will send your Login Link to your email

address. Click on the link and you will be

logged into Ed100. No more passwords to

remember!

Questions & Comments

To comment or reply, please sign in .

Carol Kocivar April 10, 2022 at 6:03 pm

Carol Kocivar April 10, 2022 at 6:02 pm

Carol Kocivar January 21, 2022 at 11:31 pm

enangriffin January 13, 2022 at 4:15 pm

enangriffin January 10, 2022 at 4:09 pm

Robin Pendoley January 10, 2022 at 3:11 pm

Carol Kocivar January 11, 2022 at 12:24 am