About nine out of ten parents expect their children to go to college. Less than a third actually do so.

In This Lesson

Why don’t students finish college?

How much does college cost in California?

How many students take loans to pay for college?

How much debt are college students taking on?

How can students find financial aid for college?

How much cheaper is college for residents?

Are scholarships bad?

What is FAFSA?

What is a Pell Grant?

How can students get help with the FAFSA application?

▶ Watch the video summary

★ Discussion Guide

Many of California's students who complete high school and start some kind of postsecondary program do not go on to earn a degree or certificate (see the previous lesson). This leaky bucket is a concern for the state and a focus for a wide variety of organizations. Why do students stop their education before they reach these completion milestones, when reaching them is so clearly in their interest?

Some of the reasons are financial. There's a good chance that a college degree will help you earn more down the road… but you can know for sure that it's going to cost you in the short run.

It's not just money

The financial strain is not the only obstacle to completing college. Applying, enrolling, scheduling, attending and obtaining transcripts are all logistical hurdles, each with their own opportunities to derail an education. Most colleges provide only limited support for these processes, and many of the reasons why students leave college have little or nothing to do with academics.

In 2014, Starbucks began offering college scholarships as a benefit for its employees, naively expecting thousands to take advantage of it. In a widely read feature story in the Atlantic, Amanda Ripley describes the practical barriers that stood in the way, and how the company improved the benefit by providing counseling support. (In 2023 the company celebrated its 10,000th graduate.)

Beyond12, a non-profit organization, works with high schools and colleges to help them effectively provide students with the academic, social, and emotional support they need to succeed in higher education. Beyond12 acts as a data and service bridge between lower and higher education systems to help them support low-income students so that more of them persist and succeed in college. Other organizations, like the Career Ladders Project focus on helping students complete career technical programs in the state’s community colleges, preparing them for well-paid careers that don’t necessarily require a four-year university degree.

California's Colleges for All

Compared to other states, California provides students with easy and inexpensive options to continue their education after high school. California’s community colleges are open access institutions — they accept all comers. About a third of California’s high school graduates go on to immediately attend a community college, which is by far the most economical option. When they take placement tests for transfer to a four-year institution, unfortunately, most students are found unready, particularly in math. Students can earn credit for remedial course work (thanks to a change in law), but remedial study can feel dispiriting, especially for students who dream of transferring to a four-year university.

...Yes, money matters. A lot.

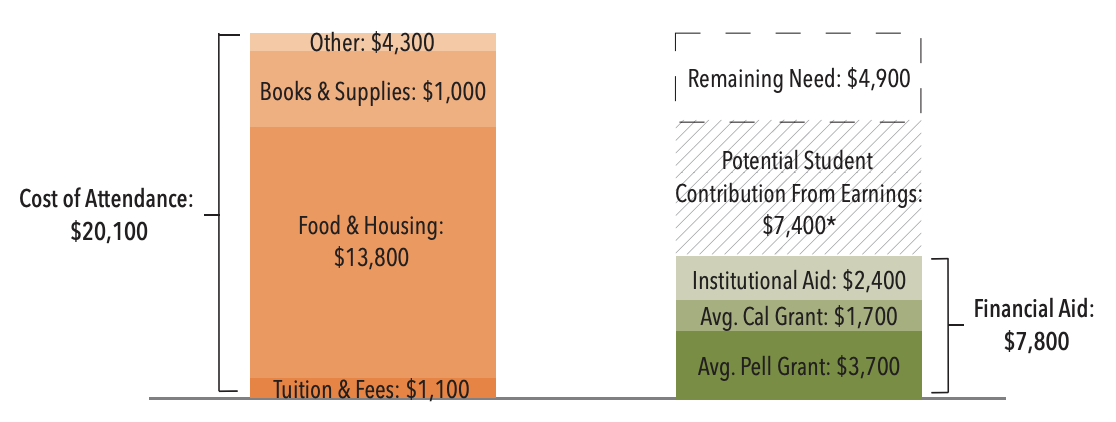

Most California residents who attend a public college qualify to receive significant financial aid from state and federal programs. After taking this aid into account, the actual net cost for students to attend college varies significantly, largely depending on family income. This practice makes it hard to compare the cost of college in California with other states. The California Legislative Analyst Office (LAO) periodically reports on this subject in its analysis of the state budget.

The cost of college is a topic of intense political interest, and there is enormous pressure to keep net costs low. In general, California has a history of holding tuition and fees flat for extended periods, followed by significant jumps when the budget faces a shortfall.

California's college tuition and fees are lower than those in most other states, especially for state residents. Even so, college is dramatically more expensive than it was a generation ago. Tuition is only part of the price tag — for most, the biggest challenge is the cost of housing. College is a major financial burden for most families, many of whom must fund short-term college costs through long-term debt.

California's college tuition and fees are lower than those in most other states.

Faced with rising tuition and declining aid, students have taken on loans in unprecedented amounts, especially for four-year degrees. In California, over half of students who graduate from a four-year degree degree program emerge with debt. For those who incur debt, the average burden exceeds $28,000.

As always, averages conceal extremes. Some students carry ruinous debt burdens. In 2022, aggregate, college loans in America surpassed 1.76 trillion dollars, exceeding the outstanding balance for credit cards, auto loans, and home equity loans. A 2019 analysis of US Department of Education data by the Center for American Progress (CAP) found that among those who borrow for college, one in three carries more than $40,000 in debt. The think tank published a blistering rebuke of the way that the US Department of Education measures student loan defaults under the title "The Student Debt Problem Is Worse Than We Imagined."

Which is bigger, America’s credit card debt or college debt?

The challenges of college affordability are not limited to four-year institutions. In 2019 the California Budget and Policy Center released a "data hit" comparing the average cost of attending community college in California on a full-time basis with 2018-19 financial aid. Even though California's community college costs are lower than other states, they are still a real stretch or out of reach for many:

Source: California Budget and Policy Center, May 2019. Assumes student earns $11 per hour and works 15 hours per week during school year and 40 hours per week during summer. Reflects deductions for taxes and some summer expenses. For more see the full data hit.

Source: California Budget and Policy Center, May 2019. Assumes student earns $11 per hour and works 15 hours per week during school year and 40 hours per week during summer. Reflects deductions for taxes and some summer expenses. For more see the full data hit.

The problems of loan distress and student bankruptcy are substantially worse at for-profit private colleges than at public colleges.

When you take out a college loan, you are the collateral

College loans have become popular with lenders because earning a degree enhances a student's future earning potential. These debts are unlike home loans or car loans, in which an asset can serve as collateral to be forfeited in a default. If you take out a college loan, you are the collateral. In order to encourage lenders to make loans to students, college loans have been made difficult to discharge through bankruptcy.

Student loans can provide necessary assistance for students looking to pay for college, but the debt problem is real. Students who take out large loans may remain in debt for decades. Such financial struggles tend to hit students of color and students from low-income backgrounds the hardest. Among students who began college in 2011, the default rate for student loans among white students was approximately 13 percent by 2017. Among Latinx students, the default rate was approximately 20 percent, and among Black students, it was approximately 34 percent. Default rates remain especially high at for-profit institutions, which disproportionately serve poor and minority students.

The Biden administration made a policy priority out of college debt in 2022, extending the timeline for students to repay federal loans. As federal student loan payments resumed after a long pause, many people faced renewed financial strain. The share of borrowers in California falling behind on payments rose to more than twice its pre-pandemic level.

Under the second Trump administration, major structural changes to federal student loans were introduced. The Trump administration moved to phase out the SAVE repayment plan, created under President Biden, requiring all borrowers to transition to a different repayment plan by July 2028. The Trump administration’s plan reduced the cap on lifetime federal borrowing for graduate students from $138,500 to $100,000, and established limits for how much debt parents could take on for the education of their children.

The good news for California is that due to relatively low tuition costs and considerable state aid, students in California rely less on federal loans than students do in other states.

What is FAFSA?

Federal financial aid for college costs is available to US citizens with financial need, if they can navigate the application for the Free Application for Federal Student Aid (FAFSA).

These applications are complex, but they are also standardized, and there are a lot of people who can help fill them out. Today's students should take at least some comfort in the knowledge that the process is much easier than it used to be. In California, students benefit from numerous state funding sources in addition to federal aid, which helps keep educational costs lower than in many other states.

The availability of financial aid varies from year to year depending on federal and state budget choices. Aid programs tend to favor students who are willing to make a commitment to work as teachers in high-need communities.

Under the California Dream Act (2013), non-citizen resident students also became eligible for state financial aid in California colleges. To qualify, they must graduate from a California high school after three full years of attendance.

To encourage college-going, some American school districts decided to make FAFSA submission a high school graduation requirement. This simple policy change boosts college enrollment rates so strongly that in 2021, California passed a bill to require all high school seniors to fill out the FAFSA, though they can opt out. A 2025 report by the Public Policy Institute of California (PPIC) found that the FAFSA completion rate improved to among the highest in America.

What is a Pell Grant?

Undergraduates may qualify for financial aid for college through a federal program called a Pell Grant after the late Senator Clairborne Pell, who first proposed it in the early 1970s. Eligibility for a Pell Grant is based on FAFSA, and this form of financial aid differs from student loans because it does not have to be repaid. In 2024, 34% of undergraduate students nationwide received a Pell Grant, and about half of funds granted were awarded to students from families with annual income less than $20,000. Students can receive a Pell Grant in addition to most other scholarships and aid.

How scholarships drive tuition costs up

Scholarships, or discounted tuition rates, are a cherished dream for college applicants. Selective colleges offer them to snag particularly attractive applicants. These financial incentives have an unavoidable dark side, of course: if Peter pays less, Paul must pay more.

Next Steps

Many organizations want to help boost the number of students who complete college.

- FAFSA (Free Application for Federal Student Aid)

- The ACT web site provides an overview of the various types of financial aid and how to apply for them.

- The California Community College system provides financial advice through its page I Can Afford College!

- The College Board (makers of the SAT and AP tests) provides tips on paying for college.

This lesson was updated in December, 2025

Quiz×

CHAPTER 9:

Success

-

Success

Overview of Chapter 9 -

Measures of Success in Education

For Kids and For Schools -

Student Success

How Well is My Kid Doing in School? -

Standardized Tests

How Should We Measure Student Learning? -

College Readiness

Preparing Students for College and Career -

Education Data in California

Keeping Track of the School System -

Achievement Gaps

The Education System's Biggest Challenge -

The California School Dashboard

Measuring California School Performance -

College in California

Options After High School -

Paying for College in California

Are College Loans Good For Students?

Related

Sharing is caring!

Password Reset

Search all lesson and blog content here.

Login with Email

We will send your Login Link to your email

address. Click on the link and you will be

logged into Ed100. No more passwords to

remember!

Questions & Comments

To comment or reply, please sign in .

Carol Kocivar November 4, 2025 at 5:15 pm

Carol Kocivar November 4, 2025 at 4:28 pm

1. The policy contributed to an increase of almost 1,500 additional students enrolling in college.

2. The share of high school seniors who completed a FAFSA and enrolled in college grew by 6 percentage points.

3. Historically underserved students experienced a greater increase in college enrollment with a completed FAFSA.

4. Students’ college choices remained mostly unchanged, with a slight shift toward public, in-state institutions.

Jeff Camp - Founder October 8, 2025 at 2:25 pm

Carol Kocivar December 30, 2024 at 1:04 pm

California recently enacted a universal financial aid application completion policy to address the issue, starting in the 2022–2023 school year. We find

Initial data suggests an increase in FAFSA/CADAA completion, particularly among low-income students.

Obstacles to implementation include parental resistance, high student-to-counselor ratios, inconsistent tracking methods, and confusion about enforcement.

https://www.ppic.org/publication/implementing-californias-universal-financial-aid-application-policy/

Carol Kocivar December 17, 2024 at 4:34 pm

Who’s the Parent on the FAFSA Form? Wizard – A new, stand-alone tool to help students and families determine who will need to provide contributor information on the FAFSA form.

Creating Your StudentAid.gov Account Page – A new resource that explains what families and partners need to know about creating a StudentAid.gov account.

Pro Tips for Completing the FAFSA Form – Updated tips for preparing to complete and submit the FAFSA form.

Federal Student Aid Estimator – This tool provides an estimate of the 2025-26 Student Aid Index and Federal Pell Grant eligibility calculation.

Federal Student Aid YouTube Channel: FAFSA Videos – Updated videos to help students and families understand the importance of the FAFSA form, who is a FAFSA contributor and what happens after submitting the form.

Jeff Camp - Founder April 4, 2024 at 1:41 pm

Carol Kocivar April 26, 2023 at 7:09 pm

The good news is that costs are not growing as fast as in prior years. I hope that's good

news.

Lots of charts:

https://research.collegeboard.org/media/pdf/trends-college-pricing-presentation-2022.pdf?utm_source=substack&utm_medium=email

Alisa Sabshin-Blek August 25, 2020 at 9:46 pm

Jamie Kiffel-Alcheh December 7, 2019 at 4:09 pm

Sonya Hendren June 11, 2020 at 2:49 pm

Susannah Baxendale March 28, 2019 at 10:43 am

Jeff Camp September 23, 2018 at 4:24 pm

Gloria Lucioni January 6, 2019 at 10:56 pm

Jeff Camp August 16, 2018 at 3:06 pm

Jeff Camp August 16, 2018 at 1:48 pm

Carol Kocivar April 8, 2018 at 1:04 pm

"This places a greater financial burden on students and their families and puts a CSU or UC education out of reach for many students from low-income households."

Read their brief

Carol Kocivar April 8, 2018 at 12:46 pm

LAO Report

CM April 2, 2018 at 11:49 am

Gloria Lucioni January 6, 2019 at 11:00 pm

Jeff Camp - Founder March 27, 2018 at 12:01 pm

Gloria Lucioni January 6, 2019 at 11:02 pm

Lisette October 4, 2017 at 12:42 pm

Jeff Camp - Founder August 29, 2016 at 4:09 pm

Jeff Camp - Founder October 13, 2015 at 6:48 pm

ellenm822 April 28, 2015 at 4:43 pm