Can Proposition 15 Untangle California's Funding Problems?

Knitting a Solution

The pandemic has unraveled California’s economy. Local governments are knitting fragile nets out of hope and debt. California schools need $20 billion next year to avoid widespread layoffs and cuts to essential programs, according to estimates from the Education Coalition. Across the nation, cities, municipal governments and pension funds face similar budget shortfalls.

At the same time, the stock market has risen to historic highs and federal tax rates on businesses profits have been reduced to historic lows.

What are the options?

- Do nothing and hope the problems disappear.

- Identify fair ways to collect taxes to fund our schools and communities.

That’s essentially what voters will decide this November when they vote on Proposition 15. (And yes, there is a long back story that involves political intrigue and heated debate — more on that later.)

What Does Proposition 15 Do?

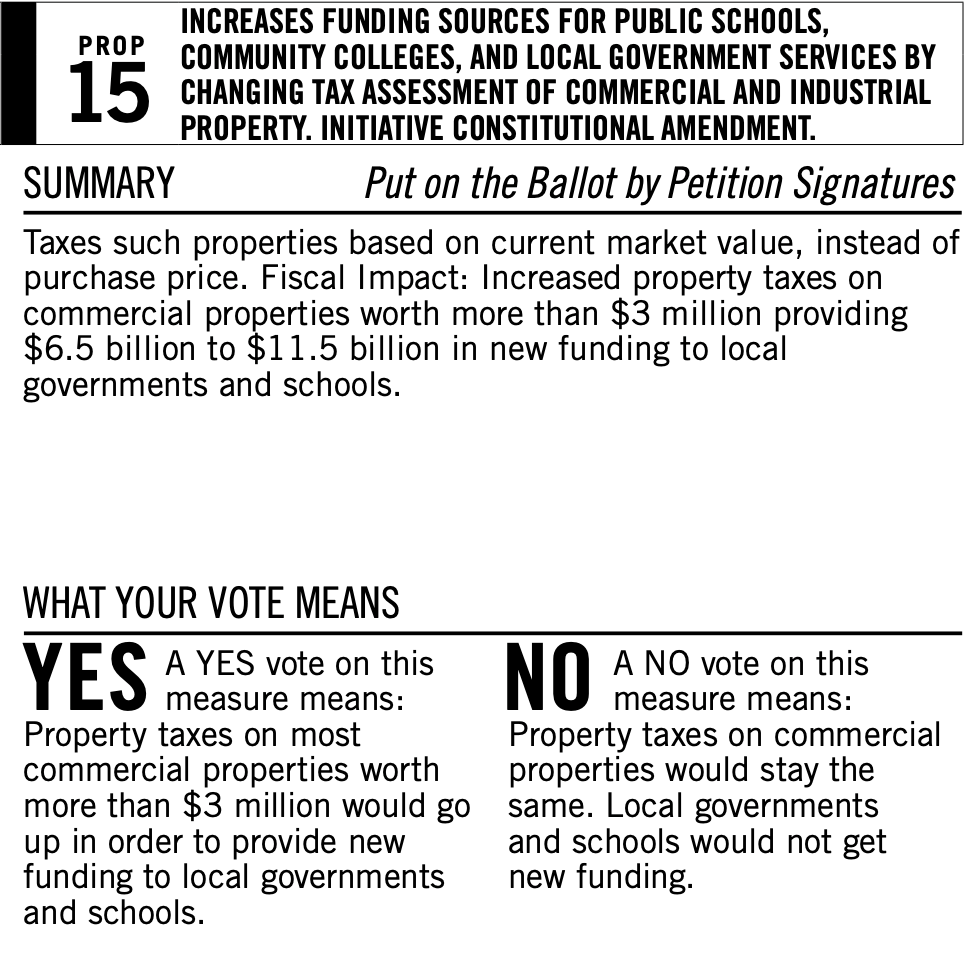

Prop. 15 does something relatively straightforward: It requires commercial and industrial real property worth more than $3 million to be taxed on the basis of its current fair market value. Right now, the tax is based on property's market value at the time of purchase (adjusted annually for inflation with increases capped at 2 percent per year) even if the purchase was decades ago.

If passed, this measure will not change residential property taxes. It will, however, bring California in line with the way other states tax commercial and industrial property: based on market value. Existing property tax rate limits remain the same. That’s it!

Wait Wait Wait!!! It must do something more than that.

A great deal of money will be spent on campaigns both for and against Proposition 15. And sometimes this results in muddled thinking by voters. Just to be clear, here is clarification for some common confusions.

- I’ve heard people warn me that it will increase taxes on my home. (NOPE.)

- I’ve heard that agricultural property will be taxed. (NOPE.)

- What about the personal property tax on small businesses? Won’t that go up? (NOPE.)

- Doesn’t it get rid of Prop. 13? (NOPE.)

The official Title and Summary for Prop.15 states that it exempts “residential properties; agricultural land; and owners of commercial and industrial properties with combined value of $3 million or less. It also exempts small businesses from personal property tax; for other businesses, provides $500,000 exemption.”

How much money will schools and communities get?

By taxing properties on the basis of their current value, Prop 15 will generate between $6.5 billion to $11.5 billion in new funding according to the California Legislative Analyst. About 60 percent of these funds will go to cities, counties, and special districts. The other 40 percent will go to K-12 schools and community colleges.

Money for K-12 schools will be distributed based on the Local Control Funding Formula (LCFF). All school districts and charter schools will get more money, with additional funds directed toward schools where needs are greatest.

|

Prop 15 estimated impact on schools and communities, selected counties |

||

|---|---|---|

|

|

||

Now let’s get to the politics!

Discussions of property tax policy in California are dominated by Proposition 13. Since it was passed in 1978, Prop. 13 has been the third rail of California politics. Don’t touch it!

In effect, Proposition 13 protects property owners by limiting increases in taxes on their property, even if their property goes up in value. California voters passed this initiative to protect Californians from being taxed out of their homes at a time when spiraling inflation was driving property prices (and thus property taxes) through the roof.

Prop 13 is the "third rail" of California politics.

California's low property tax rates on residential properties are overwhelmingly popular, and Proposition 15 doesn't touch them. The scope of the initiative is limited to commercial and industrial property.

Under Prop 13, California businesses that have owned property for a long time have enjoyed significant protection from property tax increases, even as the value of their property has risen. (Disneyland is a frequently cited example.) If Proposition 15 passes, this tax protection — basing taxes on the original purchase price — will be phased out for commercial and industrial property worth more than $3 million. As this change takes effect, businesses in California will pay taxes on property they own based on the market value of the property.

The sale of a property generally triggers reassessment of its taxable value, because it establishes a clear price. Transactions involving real property owned by a business entity, however, can sometimes be structured to avoid reassessment. Proposition 15 aims to close these loopholes.

According to former legislative staff member Jim Shultz, the politics of property taxes have evolved over the decades. In 1978 some business leaders were vocal opponents of Prop 13, which Shultz describes as a multibillion-dollar tax break they didn’t want.

“The corporations warned that the initiative would damage public schools and services, and gave serious cash to the campaign to defeat it. A Southern California Edison executive declared, 'Although business stands to receive at least $4 billion of the anticipated $6 billion in property tax relief, we felt it was time for the private sector to stand up for principle and fight this measure as financially unsound.'”

Battle over ballot language

Prop. 15’s political season started with a court battle over the statements submitted for the voter pamphlet. The court ruled that the arguments below, submitted by opponents, were false and/or misleading.

|

False or misleading statements submitted in opposition Prop 15, and court action |

|

|---|---|

|

“Prop 15 gives the Legislature the power to increase property taxes on those homeowners” |

ENTIRE PARAGRAPH DELETED |

|

“Prop 15 allows state politicians to raise property taxes on millions of home-based businesses” |

DELETED |

|

“There’s no accountability how the money is spent” |

DELETED |

|

"...and allows state politicians to raise property taxes on millions of homeowners” |

DELETED |

A separate lawsuit challenged the title in the voter pamphlet: “This blatant manipulation of the ballot label as well as the title and summary is in direct contravention of the Attorney General’s fiduciary duty to prepare impartial ballot material,” said Jon Coupal, President of Howard Jarvis Taxpayers Association. As of this date, this challenge was unsuccessful, as reported by Calmatters: Judge Earl wrote that while one portion of the title “may be somewhat misleading, the Court is not convinced the sentence is so misleading that it justifies judicial intervention.”

Because the stakes are high, court rulings may become part of the political message on both sides of the issue.

Campaign Messages for and against Proposition 15

|

|

|

While the wealthiest corporations avoid paying their fair share, our schools have the most crowded classrooms in the nation and our local communities are struggling to respond to the impact of COVID. Just 10% of California’s most expensive nonresidential commercial properties account for 92% of Prop 15’s loophole-closing revenues. Prop 15 will reclaim billions every year for our schools, community colleges, and essential local services in EVERY county to invest in things like:

|

Amid an unprecedented economic crisis, special interests are pushing Prop. 15 on the November 2020 statewide ballot. It will be the largest property tax increase in California history, and it will destroy Prop. 13’s property tax protections. The measure will raise taxes on business property. Those taxes will ultimately be passed on to consumers in the form of increased costs on just about everything people buy and use, including groceries, fuel, utilities, day care and health care. If businesses lose their Prop. 13 protections, homeowners will be next. Supporters of Prop. 15 even admitted that this initiative was the first step in a plan to end Prop. 13, which could mean skyrocketing property taxes for all California homeowners. Proposition 13 is working exceedingly well at keeping homeowners and small business owners from losing their properties, while delivering government a reliable source of revenue. |

|

Major supporters

|

Major opponents:

|

Tags on this post

Business Funding Lobbyists Politics Prop 13 Property taxesAll Tags

A-G requirements Absences Accountability Accreditation Achievement gap Administrators After school Algebra API Arts Assessment At-risk students Attendance Beacon links Bilingual education Bonds Brain Brown Act Budgets Bullying Burbank Business Career Carol Dweck Categorical funds Catholic schools Certification CHAMP Change Character Education Chart Charter schools Civics Class size CMOs Collective bargaining College Common core Community schools Contest Continuous Improvement Cost of education Counselors Creativity Crossword CSBA CTA Dashboard Data Dialogue District boundaries Districts Diversity Drawing DREAM Act Dyslexia EACH Early childhood Economic growth EdPrezi EdSource EdTech Education foundations Effort Election English learners Equity ESSA Ethnic studies Ethnic studies Evaluation rubric Expanded Learning Facilities Fake News Federal Federal policy Funding Gifted Graduation rates Grit Health Help Wanted History Home schools Homeless students Homework Hours of opportunity Humanities Independence Day Indignation Infrastructure Initiatives International Jargon Khan Academy Kindergarten LCAP LCFF Leaderboard Leadership Learning Litigation Lobbyists Local control Local funding Local governance Lottery Magnet schools Map Math Media Mental Health Mindfulness Mindset Myth Myths NAEP National comparisons NCLB Nutrition Pandemic Parcel taxes Parent Engagement Parent Leader Guide Parents peanut butter Pedagogy Pensions personalized Philanthropy PISA Planning Policy Politics population Poverty Preschool Prezi Private schools Prize Project-based learning Prop 13 Prop 98 Property taxes PTA Purpose of education puzzle Quality Race Rating Schools Reading Recruiting teachers Reform Religious education Religious schools Research Retaining teachers Rigor School board School choice School Climate School Closures Science Serrano vs Priest Sex Ed Site Map Sleep Social-emotional learning Song Special ed Spending SPSA Standards Strike STRS Student motivation Student voice Success Suicide Summer Superintendent Suspensions Talent Taxes Teacher pay Teacher shortage Teachers Technology Technology in education Template Test scores Tests Time in school Time on task Trump Undocumented Unions Universal education Vaccination Values Vaping Video Volunteering Volunteers Vote Vouchers Winners Year in ReviewSharing is caring!

Password Reset

Search all lesson and blog content here.

Login with Email

We will send your Login Link to your email

address. Click on the link and you will be

logged into Ed100. No more passwords to

remember!

Questions & Comments

To comment or reply, please sign in .

Jennifer B September 3, 2020 at 2:10 pm

And it mandates removal of over $1.5B of property tax from counties for the first time. When do we tell parents and voters in San Francisco, Santa Clara, San Mateo and Orange: your poorest schools will get under $750 a kid- while $200-$550 million goes elsewhere? (Or voters in Alameda, Contra Costa, Monterey, Marin, Napa and Sonoma, each with over $30 million leaving?) Especially with Los Angeles the big winner just because it allocates so little to education?

The news will not improve with time. It will be used as a prime example of our own duplicity. Saying “wealthy” counties should "pay their fair share” will ring even more contemptuous after the fact. This is not a simple proposition. Unless it is sold transparently, we will find 2022 voters chanting ‘… fool me twice, shame on me.’

Carol Kocivar September 4, 2020 at 12:14 pm

Leslie1 September 3, 2020 at 9:42 am

Todd Maddison September 1, 2020 at 9:19 pm

That's an increase of $5,327/ADA or 55.17%. A 6.48% compound annual growth rate, which is almost three times the rate of inflation - 2.37%/year.

But yet, that's not enough.

Why? Because most of that increased revenue has been going into pay and benefits for employees, not the list of things we were promised (similar to the list being promised in Prop 15)

In my district (Oceanside Unified), median Administrator total comp (including benefits) was $157,650 last year. Median teacher total comp $120,242.

Increase rates for both are averaging over twice inflation during this time as well.

Given it is clear the education establishment took the additional revenue we gave them and did few of the things we were promised, why would anyone think something different is going to happen this time?

Carol Kocivar September 2, 2020 at 11:34 am

Todd Maddison September 2, 2020 at 12:35 pm

Carol Kocivar September 7, 2020 at 7:15 pm

Getting Down to Facts: Effects of the Local Control Funding Formula on Revenues, Expenditures and Student Outcomes:

• The data provide initial evidence that money targeted to districts with the greatest student needs has led to improvements in student outcomes.

• Expenditure increases largely went toward teachers, pensions, and special education.

For low income students, a $1,000 increase in district per-pupil spending during ages 13 to 16 led to an average increase in 11th-grade mathematics test scores equivalent to approximately seven months of learning.

Learning Policy Institute: Money and Freedom:

LCFF-induced revenue increases:

DISTRICT: significant reduction in the average school-level student-to-teacher ratio and significant increases in average teacher salaries and instructional expenditures.

SCHOOL: significant increases in high school graduation rates and academic achievement, particularly among children from low-income families.

Todd Maddison September 13, 2020 at 5:16 am

Carol Kocivar September 15, 2020 at 3:05 pm

Carol Kocivar September 15, 2020 at 3:18 pm

jroubanis September 1, 2020 at 5:11 pm

Carol Kocivar September 2, 2020 at 11:42 am

Carol Kocivar August 31, 2020 at 6:00 pm

The initiative says in Section 3 Purpose and Intent:

Ensure that the portion of any new revenues going to local schools and community colleges as a result of this measure is treated as new revenues that are in addition to all other funding for schools and community colleges, including Proposition 98.

The text of the initiative also says:

SEC. 4. Section 8.7 of Article XVI of the California Constitution is added to read:

(c) Moneys allocated to local education agencies, as that term is defined in section 421 of the Education Code as that statute read on January 1, 2020, and to community college districts from the Local School and Community College Property Tax Fund shall supplement, and shall not replace, other funding for education.

Sonya Hendren August 31, 2020 at 12:08 pm

Can you address what in the Prop 15 language assures us that the increased property tax revenue will be in addition to the Prop 98 school funding minimums, rather than simply used to meet those minimums?

Thank you!

Andy Wheeler August 31, 2020 at 11:28 am