How is the budget for education created?

California's budget process, squeezed into one short blog post

Every year, California creates a budget for public education. How does that process work? Who creates and influences it? When are the decisions made? How can you get involved and have an influence?

...and how has the pandemic and a surging stock market changed things?

The basics

There’s good news in the Governor's budget proposal for 2022-23. We’ll get to that in a moment, but first let's back up a little.

The state operates on a fiscal year that begins each July. In January, the governor proposes a state budget based on a forecast of how much the state will take in through taxes deposited into the state's General Fund. The mix of taxes that make up the General Fund have changed over time, and the state increasingly relies on income taxes.

Next year, the total amount of anticipated revenue will reach about $212 billion according to the state Legislative Analyst Office (LAO). Another $30 billion is available from the prior year’s fund balance because taxes came in higher than forecast.

The portion of the general fund that goes to K-12 schools and public community colleges each year is determined by formulas that voters enshrined in the state constitution by passing Proposition 98 in 1988. Oversimplifying a lot, this formula usually requires that about 40% of the state General Fund should go to education. The formula includes many factors, including how well the economy is doing, whether there are more or fewer kids in public school, and changes in the cost of living.

In theory, the legislature can allocate more of the general fund to education than this formula requires. In practice, it rarely does. The governor's proposed budget for 2022-23 allocates about 38.4% of the general fund to education based on the requirements of the Prop. 98 formula.

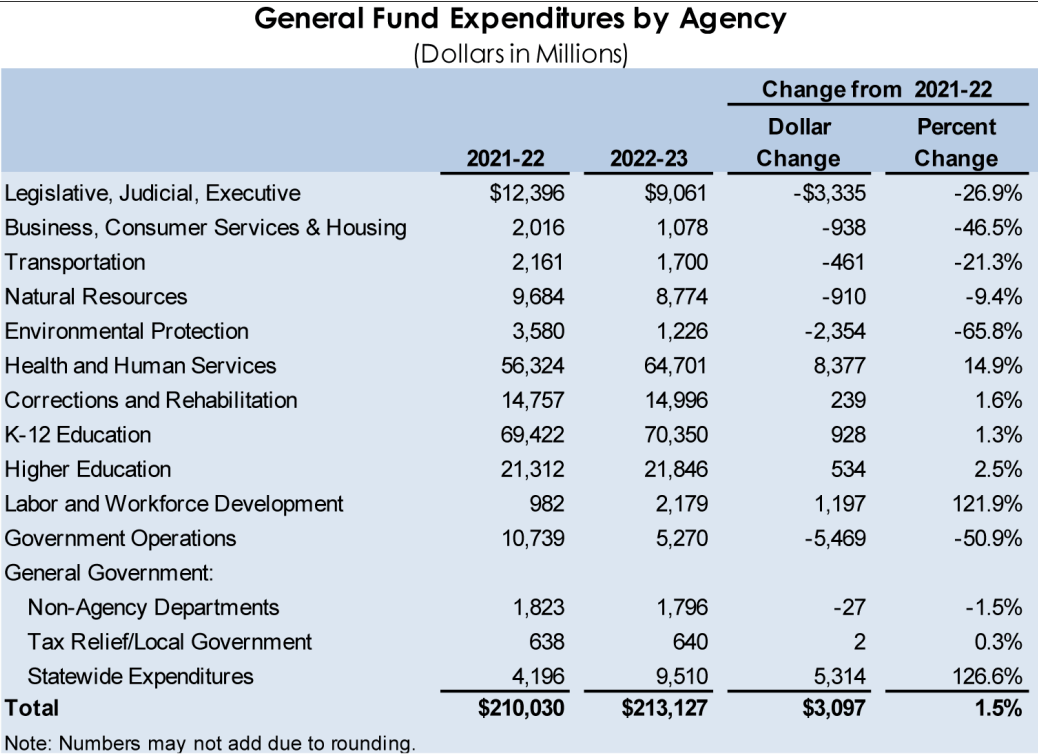

The chart below shows how the general fund is allocated for 2022-23. You can see that K-12 education gets the most money, followed by health and human services and higher education.

For additional detail, see the governor's full budget proposal. Here's a summary with some comparisons to last year's final numbers:

As dramatic as these numbers are, they don't fully capture how completely the conversation about education funding changed in the course of a single year. The early days of the pandemic featured grim conversations about deep cuts and layoffs. For a peek at the difference a pandemic year can make, compare the chart above with the Governor's proposed budget just last year.

What additional sources fund education?

Although the state General Fund accounts for most of the funding for California's K-12 education system, there are two other significant sources to know about: property taxes and federal funds.

Property taxes usually amount to somewhat less than a quarter of the money for K-12 education, but as we explain in Ed100 lesson 8.3, every year is different. Property taxes are not part of the state budget, but some property taxes are directed to education, and those taxes are included in the accounting of Prop98 budget figures.

Federal funds usually contribute less than a tenth of the cost of schools in California, but these are not normal times. California has received $15 billion in federal pandemic relief funding for things such as mental health and trauma needs, learning loss, safe return of all students in-person, full-time school and the teacher shortage.

Local funds like parcel taxes and donations aren't considered in the state budget process.

Strong state revenue: $31 billion budget surplus

Despite fears to the contrary, the economy and the stock market have continued to grow. After bracing for budget cuts, the state has to deal with a much nicer problem: How to spend an anticipated surplus of $31 billion in the upcoming budget for 2022-23. (The term surplus in this case means the difference between projected revenues and spending under current law and policy.) The surplus reflects the budget’s capacity to pay for existing commitments — and potentially new ones.

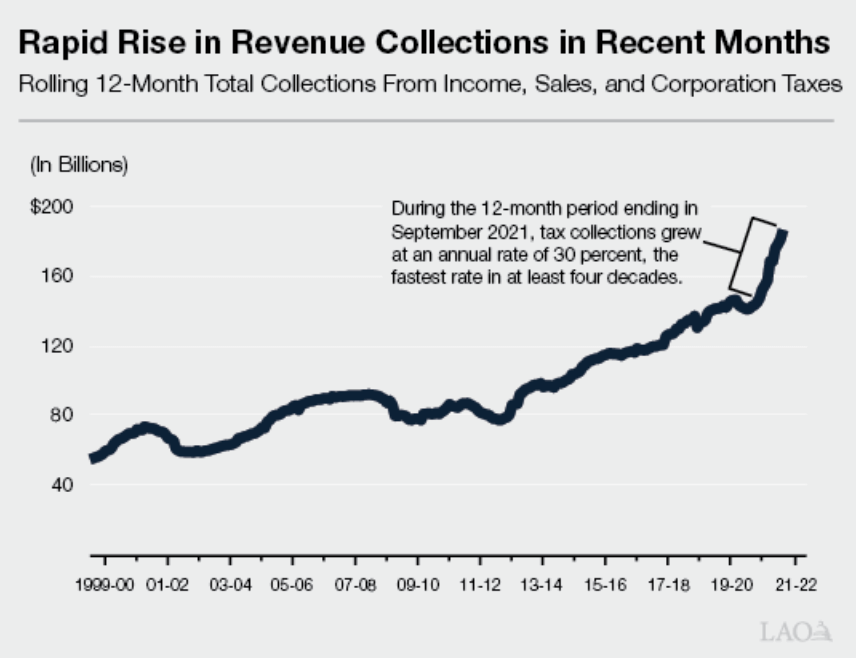

The economic growth has made folks almost giddy. The Legislative Analyst reports that state revenues have been surging. September 2021 collections from the three largest taxes (personal income, sales, and corporation taxes) were 40 percent higher than in September 2020 and almost 60 percent higher than September 2019.

“ These increases build upon extraordinary growth in several measures of economic activity. Retail sales… posted double digit growth in 2021. Stock prices have doubled from their pandemic low in the spring of 2020. Consistent with these developments, General Fund revenues under our outlook are more than $28 billion above the June 2021 estimates. ”

— California Legislative Analyst

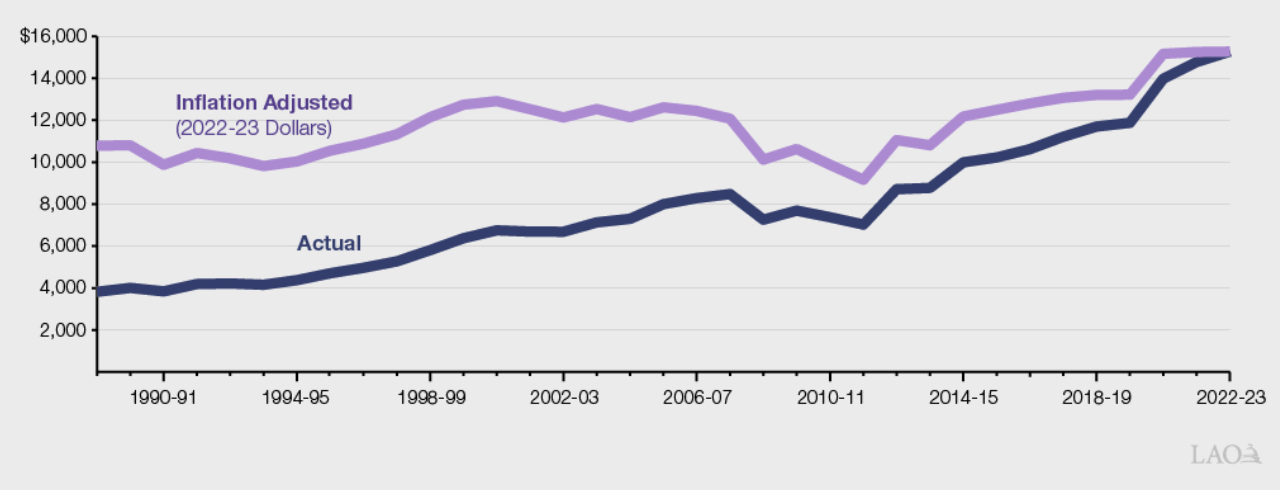

The 2022-23 education budget reflects good news: based on a cautious forecast, K-12 funding per pupil under Prop 98 will reach its highest total ever — $15,261 per pupil in the Proposition 98 General Fund and $20,855 per pupil when accounting for all funding sources.

There are two ways to look at the growth of Prop 98 funds in the budget. The budget presents it as in the chart below, highlighting the dramatic increase in dollars of funding over time.

Each year’s budget for education involves the art of forecasting the amount of taxes that will be received. When a forecast turns out to be too low, the unexpected funds due to Prop 98 are added to the next year’s Prop. 98 allocation. The orange portion at the top of the bars represents these increases, which were substantial in the past few years. It also includes funding for Transitional Kindergarten students, which has been included in the Prop. 98 calculation for the first time.

The other way to look at historical budget data is to consider it in context. Money in a budget is only good for what it can buy. Over time, inflation acts like a curved rear-view mirror: it makes historical numbers seem small and recent numbers seem big. When adjusted to account for the change in purchasing power, core funding per student isn’t all that different from 30 years ago:

K-12 Proposition 98 funding per student over time, from passage of Proposition 98 (1988) through 2022-23 under the Governor's budget. Source: LAO.

How is the education share of the budget determined?

The set of rules that allocate funds from Prop. 98 to school districts is known as the Local Control Funding Formula (LCFF). Most education dollars are allocated to districts based on the number and characteristics of students who show up to school. Under LCFF districts receive extra funds to support students in poverty, in foster care, and students learning English. (Read Lesson 8.5.)

State investments beyond LCFF. In addition to LCFF-funded investments proposed, the Governor’s budget includes initiatives outside the LCFF budget that will matter to schools and students. For example, there is funding for community schools, extended learning time (before and after school programs and summer learning), early literacy, pre-school, transitional kindergarten and resources to support, recruit and retain teachers. You can find more about these investments here.

Special education. Federal and state laws require public schools to provide for the education of children with special education needs, and both the state and the federal government provide district categorical (targeted) funding to support it. It is not enough.

As discussed in Ed100 Lesson 2.7, districts are generally expected to shoulder the extra costs as part of their obligation to educate all children. Local school districts have to meet their special education funding obligations by spending money from their LCFF funding. The Governor's 2022-23 budget includes additional state funds to support special education programs.

The Budget Process

Throughout the first half of the year, committee hearings examine both the budget itself and education bills that might have an impact on the budget. Each of these pathways is a little different. (The California Budget & Policy Center, a non-profit organization, does a great job of explaining the distinction between these two paths.)

By January 10, the Governor officially kicks off the budget process by proposing a budget with support from the state Department of Finance. Budget committees in the Senate and Assembly consider the Governor's proposed budget as a whole. Subcommittees in the Senate and Assembly separately examine the proposed budget for education. These hearings are open to the public. When agendas are set, you can find them online.

After the Governor releases the proposed budget, advocates react, shoring up support for the parts they favor and scrambling to make adjustments.

By May 14, the Governor releases a revised budget, reflecting more up-to-date financial information. (You guessed it, it's called the May Revise). Separately, the Budget Committees of the Senate and Assembly also each adopt their version of the budget. A conference committee irons out differences between these versions.

By June 15, the Senate and Assembly leaders huddle with the Governor to hash out the final details and pass a balanced budget by a majority vote of both houses. If the process gets stuck and they don't pass a budget on time, legislators are not paid, based on an initiative passed in 2010 after a series of budget delays.

On July 1, the state begins the new fiscal year. Between the passage of the budget by the legislature and July 1 the Governor may cut specific expenditures using line-item vetos. This is rare. In 2020 it was used once.

Education Policy Bills: A Parallel Process

At the same time as the main budget bills are in the works, the Senate Education and Assembly Education committees consider policy bills that affect education. Some policy bills approved by these committees involve money. If a bill requires significant money, it must survive passage through the Senate Appropriations or the Assembly Appropriations Committee. Many bills die in these committees because the cost is too high.

The budget bill is adopted by July 1, but education policy bills continue the legislative process through the summer. Similar to the federal process, after a bill passes one house, it must then go to the other for consideration. (The adopted budget may be revised a bit, with the Governor's approval, to include funding in these adopted

How You Can Get Involved

That’s why you are reading this, right? You want to know how you can get informed and have some say in the budget process.

Get Informed. Throughout the development of the budget, the Legislative Analyst's Office provides detailed information and analysis. You can sign up to be notified whenever there is a new report. Separately, the California Department of Finance offers information on the current Governor's budget, as well as budget information from past years.

As bills work their way through the legislative process, you can find information about them on the state's Leg Info page (it's pronounced "ledge info").

Support an organization's voice. Some education organizations take positions on bills under consideration, and may or may not make those positions public. For example, you can find current positions of the California State PTA online. Other vocal advocates include the California Charter Schools Association and the California Teachers Association.

Hear Carol's radio interview about how to be heard.

Participate in public comment. The legislative process includes opportunities for public comment. Agendas are posted online. The California Senate and the California Assembly provide live webcasts of legislative hearings. The Senate and Assembly committees have staff members who take their work seriously and may be able to help provide more information about legislation.

Meet with your legislator. Legislators welcome contact with their constituents, especially this year because the census is causing many district boundaries to change. Why not set up a meeting with the office of your legislator to discuss an issue you care about? Frequently, you will be directed to the staff person who is responsible for education issues.

Tags on this post

Budgets Funding Planning Spending Year in ReviewAll Tags

A-G requirements Absences Accountability Accreditation Achievement gap Administrators After school Algebra API Arts Assessment At-risk students Attendance Beacon links Bilingual education Bonds Brain Brown Act Budgets Bullying Burbank Business Career Carol Dweck Categorical funds Catholic schools Certification CHAMP Change Character Education Chart Charter schools Civics Class size CMOs Collective bargaining College Common core Community schools Contest Continuous Improvement Cost of education Counselors Creativity Crossword CSBA CTA Dashboard Data Dialogue District boundaries Districts Diversity Drawing DREAM Act Dyslexia EACH Early childhood Economic growth EdPrezi EdSource EdTech Education foundations Effort Election English learners Equity ESSA Ethnic studies Ethnic studies Evaluation rubric Expanded Learning Facilities Fake News Federal Federal policy Funding Gifted Graduation rates Grit Health Help Wanted History Home schools Homeless students Homework Hours of opportunity Humanities Independence Day Indignation Infrastructure Initiatives International Jargon Khan Academy Kindergarten LCAP LCFF Leaderboard Leadership Learning Litigation Lobbyists Local control Local funding Local governance Lottery Magnet schools Map Math Media Mental Health Mindfulness Mindset Myth Myths NAEP National comparisons NCLB Nutrition Pandemic Parcel taxes Parent Engagement Parent Leader Guide Parents peanut butter Pedagogy Pensions personalized Philanthropy PISA Planning Policy Politics population Poverty Preschool Prezi Private schools Prize Project-based learning Prop 13 Prop 98 Property taxes PTA Purpose of education puzzle Quality Race Rating Schools Reading Recruiting teachers Reform Religious education Religious schools Research Retaining teachers Rigor School board School choice School Climate School Closures Science Serrano vs Priest Sex Ed Site Map Sleep Social-emotional learning Song Special ed Spending SPSA Standards Strike STRS Student motivation Student voice Success Suicide Summer Superintendent Suspensions Talent Taxes Teacher pay Teacher shortage Teachers Technology Technology in education Template Test scores Tests Time in school Time on task Trump Undocumented Unions Universal education Vaccination Values Vaping Video Volunteering Volunteers Vote Vouchers Winners Year in ReviewSharing is caring!

Password Reset

Search all lesson and blog content here.

Login with Email

We will send your Login Link to your email

address. Click on the link and you will be

logged into Ed100. No more passwords to

remember!

Questions & Comments

To comment or reply, please sign in .

luca February 15, 2022 at 3:24 pm

If true, it would mean that our state would make it from the 44th in the nation per student in education spending into the top 10.

Jeff Camp - Founder February 16, 2022 at 2:47 pm

Jeff Camp - Founder February 16, 2022 at 2:48 pm

luca February 19, 2022 at 11:13 pm

Carol Kocivar March 10, 2022 at 4:49 pm

Carol Kocivar March 10, 2022 at 4:50 pm