The Education Budget, explained (2025-26)

Making $ense of education funding

Each January, the governor proposes a state budget based on a forecast of how much the state and school districts will take in through taxes. Using the proposed budget for 2025-26, this post walks you through how money flows.

Heads up! We’ve included pop quizzes in this post. Critical thinking is alive and well at Ed100!

- The good news for K-12 schools is that education funding remains stable in this budget, with no significant cuts and some proposed investments to improve literacy and math.

- The better news is that the state’s system of rainy-day reserves seems to be working.

- The bad news is that attendance is projected to continue to decline and federal COVID relief funds are expiring.

The Budget Big Picture

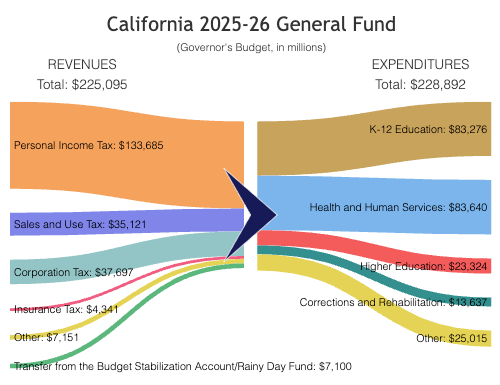

Most of the California budget, especially including funds for education, is contained in the state General Fund. The schematic below shows where state money comes from and where it goes. On the left you can see that the largest revenue source coming in is personal income taxes. On the right, you can see that the biggest expenditures flow out to Health and Human Services and K-12 Education.

Quiz: Which is greater: General Fund revenue or expenses?

Look closely. Budgeted expenses (right side) are more than revenue (left side).

Mind the Gap

Did you notice the gap between revenues and expenditures in the schematic above? It’s not a typo — the proposed budget calls for California to spend a few billion dollars more than it takes in. This might sound rash, but in an economy the size of California, a billion here or there isn’t as big as it sounds. More importantly, California has a plan: rainy day funds.

How do California’s Rainy Day Funds work?

Rainy day funds smooth out year-to-year changes in revenue

Like virtually all states, California’s constitution requires a balanced budget. Achieving balance has long been a challenge in this state, and the challenge has grown with income inequality. In years when the economy is strong and the stock market goes up, investors who sell for a profit earn taxable capital gains. Tax receipts rise and all is well. In years when the economy stumbles, by contrast, tax receipts slow or fall. The boom-bust pattern, called revenue volatility, makes balancing the budget each year very difficult.

The common-sense solution — save in good years to endure tough ones — took a long time to put in place. Voters created the state’s system of rainy day funds gradually. In 2004, as part of the California Balanced Budget Act, voters created the Budget Stabilization Account (BSA). Ten years later, voters enthusiastically expanded the BSA, authorizing it to a size of up to 10% of the General Fund. Education funding received additional protection with the creation of the Public School System Stabilization Account (PSSSA).

Most school districts keep their own rainy day funds, too. It can be difficult, though. If a district has funds saved, it can be politically difficult to leave them unused. This is part of the reason why districts take on debt to make big expenditures.

Quiz: California is legally required to have a balanced budget. How do you balance a budget with less revenue than expenses?

Use “Rainy-Day” Reserves (e.g. California Proposition 2)

Governments use reserve funds to save money when the economy is doing well. When the economy worsens or revenues decline, governments use the saved funds to sustain services. Economically, this practice helps to limit patterns of economic gloom or exuberance that can become self-reinforcing.

In 2024, California faced a huge budget deficit. To balance the budget, the 2024 Budget Act drew approximately $5.1 billion from the rainy day fund in 2024-25. As of this writing in January 2025, revenues have come in a few billion ahead of forecast. The Governor’s Budget projects that it will withdraw $7.1 billion in 2025-26.

Predictions are hard!

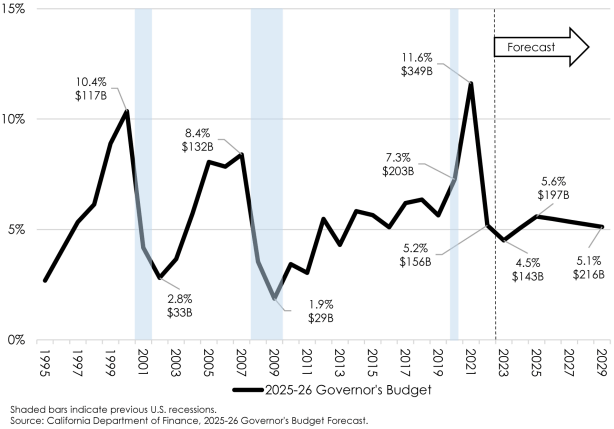

About half of California’s state income tax revenue each year comes from taxes paid by the top 1% of earners. When stocks rise, investors who sell them pay taxes on their capital gains. When the market is hot (as in 2021), capital gains have amounted to as much as 11.6% of the economic activity of the state. In a cold year, when investors’ gains are offset by losses, they have amounted to as little as 1.9%.

The graph below, which the governor shows in almost every budget presentation, shows the dramatic ups and downs of capital gains as a percentage of the California economy.

This volatility makes it very hard to accurately create a balanced budget as required by law. All kinds of things can change in the course of a budget year. Here are some known areas of risk:

- Costs related to wildfires or other disasters

- Possible cuts to federal education funding

- Economic impacts of mass deportations

- Inflation concerns driven by increased trade tariffs

- Cuts to health care

- Moodiness in the market

Warning! The proposed budget could change in May

The budget process for 2024-25 was disrupted and delayed by wildfires, leading to flawed revenue predictions and unanticipated cuts. Deja vu all over again. Governor Newsom has issued an executive order to suspend penalties, costs, and any interest accrued on late property tax payments until April 10, 2026, for properties in areas affected by the firestorm. This has the effect of extending the deadline for residents in those areas.

If other disasters lead to another delay in tax filing, the problem could be repeated.

State budget basics: the General Fund

California operates on a fiscal year that begins in July (matching the school year). Under public scrutiny, the Governor’s January proposal is formally revised each year in May. A budget bill must be passed by the legislature and signed by the Governor by June 30.

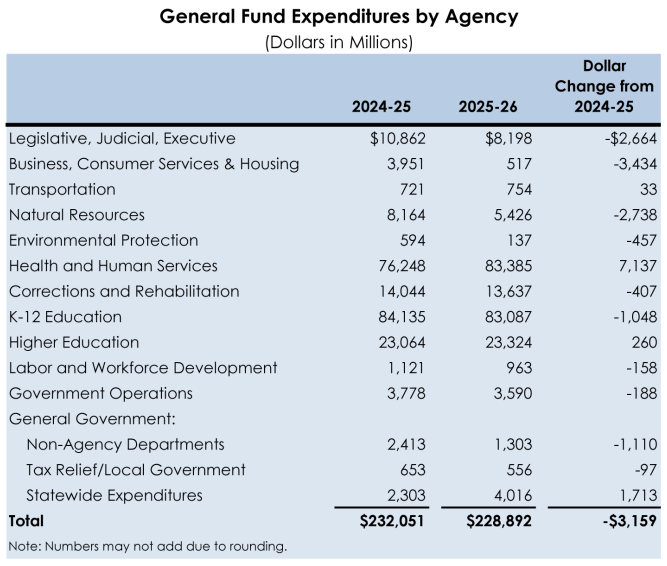

The table below looks at how money is spent in the proposed 2025-26 state budget, compared to 2024-25.

Here's a visual version of the General Fund proposal for 2025-26:

Quiz: Is funding for corrections (prisons) larger than funding for education?

No. Not even close. Every year we hear people complaining that we spend more on prisons than on schools. It’s not true. Compare the light blue slice in the pie chart above to the orange slice. The confusion comes from the fact that we spend more on each prisoner than we do on each student.

How is the education share of the state budget determined?

California’s constitution requires about 40% of the state General Fund to be directed to public TK-12 schools and community colleges. In combination with local property taxes for education, this is called the Prop 98 budget, explained in Ed100 Lesson 8.4.

Prop. 98 funds are distributed to school districts, county offices of education and charter schools based on the Local Control Funding Formula (LCFF), which we explain in Ed100 Lesson 8.5. School districts then allocate money to pay for staff and programs in individual schools.

In the LCFF system, districts get more money for their schools where students have more needs. Some of the money from the state also pays for targeted categorical needs such as Special Education. In addition to state funds, schools also receive local funds and federal funds.

Quiz: What gets more money: LCFF or Special education?

LCFF and special education operate separately. Whereas special education funding relates to individual students, LCFF guides overall funding through districts, modified by the needs of groups of students. Overall, funding for LCFF is a much bigger part of the system than funding for special education.

Prop 98 explained, briefly

The portion of the state General Fund that goes to K-12 schools and public community colleges each year is determined by formulas that voters enshrined in the state constitution by passing Proposition 98 in 1988.

The formula includes many factors, including how well the economy is doing, whether there are more or fewer kids showing up to public school, and changes in the cost of living.

In theory, the legislature can allocate more of the general fund to education than this formula requires. In practice, it rarely does. The governor's proposed budget for 2025-26 allocates about 39.6% of the general fund to education. This reflects the continued implementation of universal Transitional Kindergarten. In addition, schools get funding for Arts education from the general fund.

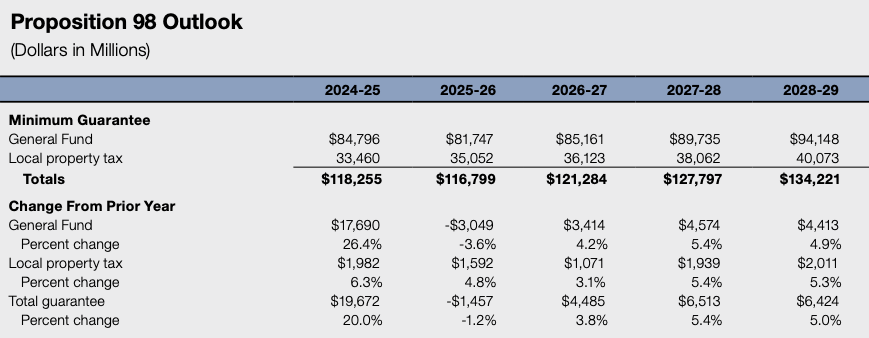

The table below shows guesstimates from the state Legislative Analyst Office (LAO) as of November 2024 for TK-14 education funding.

Quiz: Will funding for education go up in future years?

According to the LAO forecast and the Governor's three-year outlook, yes. But bring your own crystal ball — funding for education relies on continuing political will. For example, some education funding from income taxes paid by the state's highest earners (over a million per year) is scheduled to expire in 2030.

How is the money in Prop. 98 allocated?

Money is allocated based on the number of students who show up to school. That means attendance counts, not enrollment. The Local Control Funding Formula directs more money to districts to support students who are low income, in foster care, and/or learning English. (There’s more to it — read Ed100 Lesson 8.5.)

The table below shows highlights from how the Governor’s budget proposes to fund education in 2025-26.

|

Education funding by the numbers, 2025-26 Governor's Budget |

|

|---|---|

|

Prop 98 K-12 funding per pupil in attendance |

$18,918 Proposition 98 General Fund and $24,764 when the contribution of all sources including local property taxes and federal programs are included. Note: California is one of the few states that bases its funding per pupil calculation on attendance. Most states use enrollment. This difference in definition regularly leads to confusion when comparing state education funding. |

|

LCFF cost-of-living adjustment |

2.43% increase. When adjusted for population growth, this will result in an increase of roughly $2.5 billion in discretionary funds for school districts and county offices of education. |

|

Prop. 98 Guarantee for TK-12 schools and community college |

$118.9 billion in 2025-26. Due to the inherent risk in revenue projections, the budget proposes to appropriate the Guarantee at $117.6 billion. $119.2 billion in 2024-25 $98.5 billion in 2023-24 |

|

Proposition 98 Rainy Day Fund balance |

$1.1 billion in the Public School System Stabilization Account (PSSSA) |

Which programs are funded in the education budget?

In addition to the flexible money that is distributed to school districts under LCFF, the budget also funds specific programs that reflect significant priorities of the Governor and the legislature. The table below lists some of them.

| Educational Priorities in the budget | |

|---|---|

|

Universal Transitional Kindergarten (TK) |

$2.4 billion ongoing to support full implementation of universal Transitional Kindergarten, so that all children who turn four years old by September 1 can enroll. This provides access to roughly 60,000 additional children. |

|

Before School, After School, and Summer School |

Increase funding to offer universal access to expanded learning programs in TK-6 schools with 55% or more low-income students, English learners, and foster youth students. $435 million ongoing to cover the cost of full implementation, increasing the total ongoing program funding to $4.4 billion. |

|

Master Plan for Career Education: TK-12 Education |

$1.8 billion Student Support and Discretionary Block Grant per the Master Plan for Career Education. Includes dual enrollment and pathways programs as allowable expenditures. $3 million increase ongoing to support the California College Guidance Initiative and the Cradle-to-Career Data System. |

|

Literacy Instruction |

$500 million one-time for TK-12 literacy and math coaches. $40 million in 2025-26 to support necessary costs, including purchasing screening materials and training for educators, to administer literacy screenings. $5 million through 2029-30 to serve as a clearinghouse for state-developed literacy resources, elevate best practices, and support select districts facing persistent performance challenges. $300,000 one-time to develop a curriculum guide and resources in personal finance. $1.8 billion for the Student Support and Discretionary Block Grant, which can fund professional development for teachers on the ELA/ELD Framework and the Literacy Roadmap. |

|

Teacher Preparation and Professional Development |

$150 million one-time to provide financial assistance for teacher candidates through the new Teacher Recruitment Incentive Grant Program. $100 million one-time to extend the timeline of the existing National Board Certification Incentive Program to support teachers to teach and mentor other instructional staff in high poverty schools. |

|

Student Support and Professional Development |

$1.8 billion one-time discretionary block grant. |

|

School Facility Program |

The 2024 Bond Act (Proposition 2) authorizes a total of $8.5 billion in state General Obligation bonds for K-12 schools. |

|

Learning Recovery Emergency Block Grant |

$378.6 million one-time grant. |

|

Cost-of-Living Adjustments |

$204 million ongoing Proposition 98 General Fund to reflect a 2.43-percent cost-of-living adjustment. |

|

Kitchen Infrastructure and Training |

$150 million one-time for specialized kitchen equipment, infrastructure, and training to support schools in providing more freshly prepared meals made with locally grown ingredients. |

|

Nutrition |

$106.3 million in additional ongoing to fully fund the universal school meals program in 2025-26. |

|

English Language Proficiency Screener for Transitional Kindergarten Students |

$10 million one-time for the statewide use of English language proficiency screeners to support multilingual learnings in transitional kindergarten. |

|

TK-12 High Speed Network |

$3.5 million in additional ongoing to support the K-12 High Speed Network program. |

|

IEP Template Translation and Digitization |

$2 million one-time to support the digitization of the template for Individualized Educational Programs (IEPs) and translate it into multiple languages. |

|

Homeless Education |

$1.5 million for Technical Assistance Centers |

|

Curriculum Framework, Standards, and Instructional Materials Process |

$1 million to evaluate the state’s process for developing and adopting standards, curriculum standards, curriculum frameworks, and instructional materials and make recommendations to streamline and improve the process. |

What does inflation do to school funding?

There are two major ways to look at the growth of Prop 98 funds over time. The governor's budget presents it as in the chart below.

The chart visually suggests that funding for California's students has risen massively over time. Well, there are at least three things to consider:

- Inflation understates the real value of old dollars

- 2012-13 was a low point in education funding power

- The number of students served has changed over time. The relevant metric isn't just dollars, but dollars per student.

Here’s an example of a more complete analysis we created on close inspection of last year’s budget, focused just on K-12:

We’ll try to build an updated analysis along these lines soon. (It requires a bit of analytical magic: untangle TK-12 funds and K-14 funds from both state and local sources, identify figures for enrollment, then find and apply the relevant cost deflator series.)

The budget process ahead

Throughout the first half of the calendar year, committee hearings examine both the budget itself and education bills that might have an impact on the budget. Each of these pathways is a little different. (The California Budget & Policy Center, a non-profit organization, does a great job of explaining the distinction between these two paths.)

Going to the source

Tags on this post

BudgetsAll Tags

A-G requirements Absences Accountability Accreditation Achievement gap Administrators After school Algebra API Arts Assessment At-risk students Attendance Beacon links Bilingual education Bonds Brain Brown Act Budgets Bullying Burbank Business Career Carol Dweck Categorical funds Catholic schools Certification CHAMP Change Character Education Chart Charter schools Civics Class size CMOs Collective bargaining College Common core Community schools Contest Continuous Improvement Cost of education Counselors Creativity Crossword CSBA CTA Dashboard Data Dialogue District boundaries Districts Diversity Drawing DREAM Act Dyslexia EACH Early childhood Economic growth EdPrezi EdSource EdTech Education foundations Effort Election English learners Equity ESSA Ethnic studies Ethnic studies Evaluation rubric Expanded Learning Facilities Fake News Federal Federal policy Funding Gifted Graduation rates Grit Health Help Wanted History Home schools Homeless students Homework Hours of opportunity Humanities Independence Day Indignation Infrastructure Initiatives International Jargon Khan Academy Kindergarten LCAP LCFF Leaderboard Leadership Learning Litigation Lobbyists Local control Local funding Local governance Lottery Magnet schools Map Math Media Mental Health Mindfulness Mindset Myth Myths NAEP National comparisons NCLB Nutrition Pandemic Parcel taxes Parent Engagement Parent Leader Guide Parents peanut butter Pedagogy Pensions personalized Philanthropy PISA Planning Policy Politics population Poverty Preschool Prezi Private schools Prize Project-based learning Prop 13 Prop 98 Property taxes PTA Purpose of education puzzle Quality Race Rating Schools Reading Recruiting teachers Reform Religious education Religious schools Research Retaining teachers Rigor School board School choice School Climate School Closures Science Serrano vs Priest Sex Ed Site Map Sleep Social-emotional learning Song Special ed Spending SPSA Standards Strike STRS Student motivation Student voice Success Suicide Summer Superintendent Suspensions Talent Teacher pay Teacher shortage Teachers Technology Technology in education Template Test scores Tests Time in school Time on task Trump Undocumented Unions Universal education Vaccination Values Vaping Video Volunteering Volunteers Vote Vouchers Winners Year in ReviewSharing is caring!

Password Reset

Search all lesson and blog content here.

Login with Email

We will send your Login Link to your email

address. Click on the link and you will be

logged into Ed100. No more passwords to

remember!

Questions & Comments

To comment or reply, please sign in .