The 2026-27 Education Budget, Explained

Making sense of education funding

Each January, California’s governor proposes a state budget based on a forecast of how much the state and school districts will take in through taxes. Using the proposed budget for 2026-27, this post walks you through how money flows, with a focus on education.

Heads up! We’ve included quizzes in this post. Look for them and click to reveal the answers.

There is some good news for K-12 schools in this budget: With the stock market up, inflation in check, and the number of students to serve in the state basically steady, there is some more state money. Education funding will go up for many programs. A few highlights:

- More money for community schools, teacher residencies, and learning recovery programs.

- $40 million to continue screening all K-3 students to identify risk of reading difficulties.

- $100 million to increase access to college and career pathways for high school students.

- The bad news: The costs of special education and healthcare are growing faster than revenues.

- The budget focuses on the continued implementation of previous investments, not new programs.

Not everyone is comfortable with this budget. The state’s independent Legislative Analyst’s Office (LAO) characterizes the multi-year proposal as “alarming” because it predicts a financial downturn in years ahead. The California Teachers Association (CTA) accuses the proposal of playing a $5.6 billion “shell game” to put off committing funds owed to schools.

School boards will have to reach their own point of view about how aggressively or cautiously to manage resources, balancing today’s needs with the possibility of leaner times ahead.

The Budget Big Picture: Budget Magic

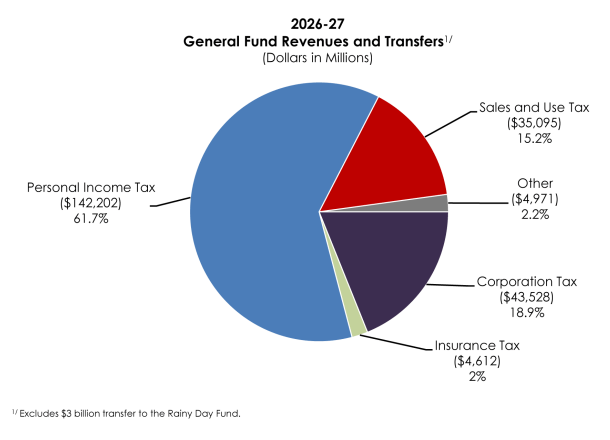

Let’s start with a quick look at where the money comes from and where it goes. This has an important impact on education because the state constitution requires about 40 percent of the general fund to be spent on education.

Revenue from the state

Most of the California budget, especially state funds for education, is contained in the state General Fund. The pie charts below show where this state money comes from and where it goes. You can see that the largest revenue source is personal income taxes.

Public school funding also relies on local property taxes, which tend to vary much less than income taxes. Federal support for public education, significant in the pandemic, has plummeted as a share of funding.

Quiz: Revenues are better than expected. What do you think caused this?

If you guessed the stock market and investments fueled by optimism about artificial intelligence, BINGO. You got this right.

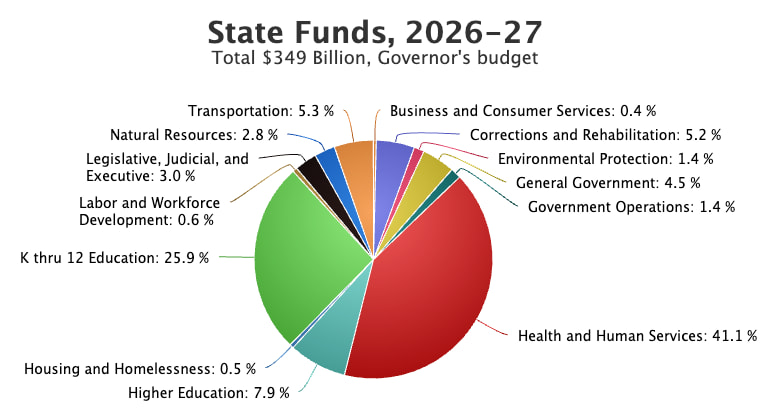

Where does the money go?

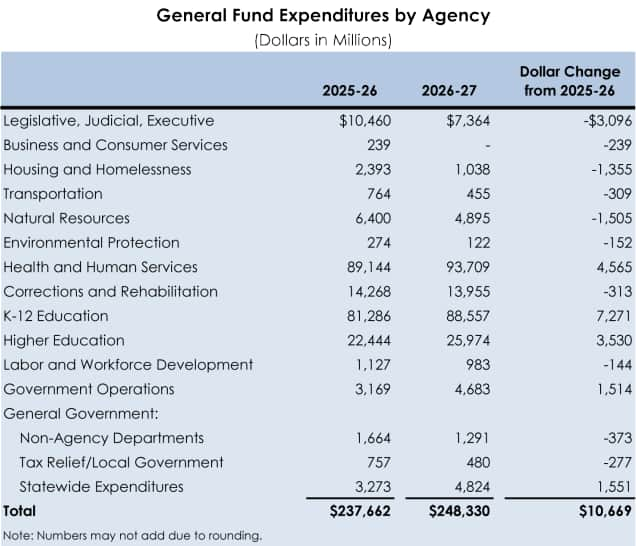

The revenues are marked to flow to Health and Human Services, K-12 Education, and other areas like higher education and transportation.

Quiz: What gets the biggest share of the state general fund budget?

Look carefully. In the past, you could confidently say that education received the largest portion of the state general fund budget. Not any more. The answer is now Health and Human Services.

The federal budget has cut support for health and food assistance, inflicting new costs on the state budget. To protect Health and Human services, California is adding about $1.4 billion to General Fund expenses in 2026-27.

- Health care: $1.1 billion in additional costs. Medi-Cal, California’s Medicaid program, provides health care services for more than 14 million low-income Californians including kids, parents, and people who support them.

- Food aid: Nearly $300 million in costs to CalFresh, the state’s Supplemental Nutrition Assistance Program, which helps put food on the table for more than 3 million California households.

Elections have consequences. Federal cuts to Health and Human Services is one consequence. These are basic resources children need to do well in school. There may be more federal cuts ahead that further hurt children and families, which would require the state to make tough decisions in a tough budget. Anyone interested in education needs to pay close attention to this.

Balancing the budget

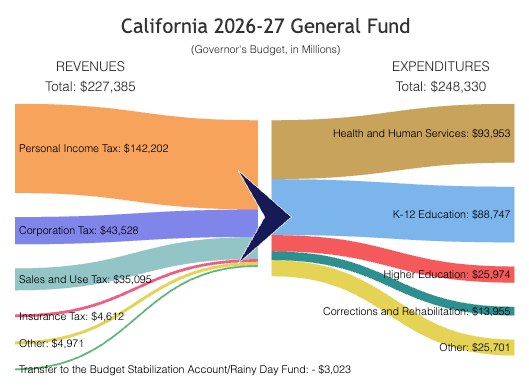

The chart below compares revenue to expenses in the General Fund.

Quiz: Which is greater: General Fund revenue or expenses?

Yes, $248 billion in expenses is greater than $227 billion in revenue. The difference, about $21 billion, is best seen as a symptom of the complexity of public sector accounting.

California’s state budget is always a three year exercise in informed guessing, subject to recalibration and revision as taxes and facts are collected and digested. The budget for 2026-27 involves assumptions about 2025-26, still in progress, and 2024-25, with remaining collections still underway. The state uses rainy-day reserves to cushion the impact of lean budget years.

Net of reserves, the Governor’s proposed budget projects a shortfall that the Department of Finance pegs at $2.9 billion. The state Legislative Analyst, in contrast, sees an almost $18 billion shortfall. These numbers are huge — but they are also small in the context of California’s dynamic $4.1 trillion economy. Financial markets signal confidence in the state’s credit.

How do California’s Rainy Day Funds work?

Did you notice the gap between revenues and expenditures? It’s not a typo — the proposed budget calls for California to spend more than it takes in.

Rainy day funds smooth out year-to-year changes in revenue

Like virtually all states, California’s constitution requires a balanced budget. Achieving balance has long been a challenge in this state, and the challenge has grown with income inequality.

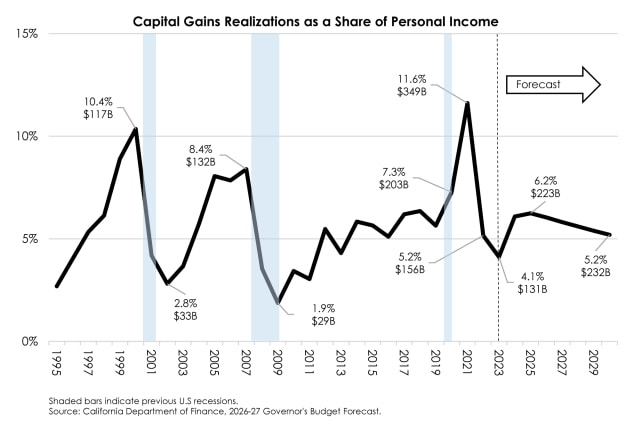

In years when the economy is strong and the stock market goes up, investors who sell for a profit earn taxable capital gains. State tax receipts rise on these gains, generating funds for schools and other functions.

In years when the economy stumbles, by contrast, tax receipts slow or fall. Investors’ capital losses offset their gains and reduce their taxes. The boom-bust pattern, called revenue volatility, makes balancing the budget each year very difficult.

The common-sense solution — save in good years to endure tough ones — took a long time to put in place, and it’s complex. Voters created the state’s system of five rainy day funds gradually. In 2004, as part of the California Balanced Budget Act, voters created the Budget Stabilization Account (BSA). Ten years later, voters enthusiastically expanded the BSA, authorizing it to a size of up to 10% of the General Fund. Education funding got additional protection with the creation of the Public School System Stabilization Account (PSSSA). The rules that govern these accounts are rigidly defined in the laws that California voters put in place for them. Governors and legislators cannot ignore these rules to “tap” reserve funds or build them at their whim.

Most school districts keep their own rainy day funds, too, but at low levels. California law imposes a “reserve cap” level of 10% on districts (except small ones). There is political logic behind this restriction: districts without savings cannot easily weather a strike, for example. There are business interests at stake, too — if districts can’t save up for big expenditures they have to finance them through debt.

Quiz: California’s constitution requires a balanced budget. How do you balance a budget with less revenue than expenses?

By managing a system of five rainy day reserves. It helps to be lucky, too.

In 2024, California faced a huge state budget deficit. As a result, over the last two fiscal years, the state withdrew approximately $12.2 billion from the BSA. The Governor’s proposed budget for 2026-27 rebuilds reserves. It includes $4.5 billion in the Special Fund for Economic Uncertainties and $4.1 billion in the Public School System Stabilization Account—bringing the total amount of reserves in 2026-27 to roughly $23 billion. Again, read California Reserves Explained from the Cal Budget Center to explore these funds.

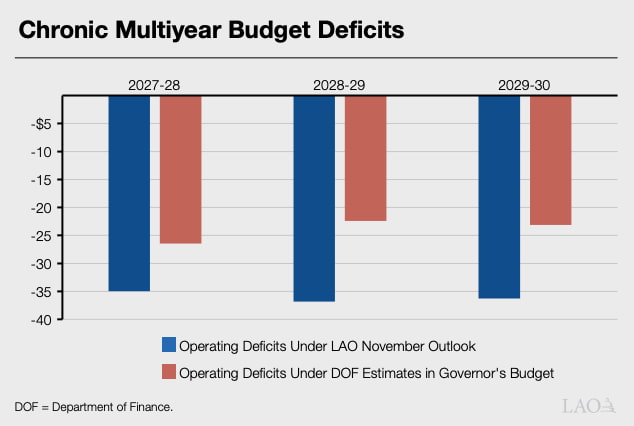

While the Budget is formally balanced in the 2026-27 fiscal year, with a discretionary reserve of $4.5 billion, it projects a deficit of roughly $22 billion in the 2027-28 fiscal year and shortfalls in the two years following. See California 2026-27 proposed budget.

Predictions are hard!

California’s wealthiest taxpayers fund our schools

In most years, about half of California’s state income tax revenue comes from taxes paid by the top 1% of earners. When stocks rise, investors who sell them pay taxes on their realized capital gains. When the market is hot (as in 2021), capital gains have amounted to as much as 11.6% of the economic activity of the state. In a cold year, when investors’ gains are offset by losses, they have amounted to as little as 1.9%.

The graph below, which the governor shows in almost every budget presentation, shows the dramatic ups and downs of capital gains as a percentage of the California economy.

From the state budget summary: “The Budget projects capital gains realizations to increase 8 percent in 2025 and 1 percent in 2026, compared to a 15-percent decline in 2025 and flat growth in 2026 assumed in the 2025 Budget Act.”

This volatility makes it very hard to accurately create a balanced budget as required by law. All kinds of things can change in the course of a budget year. Here are some known risks:

- Stock market and asset price declines—shocks that disproportionately impact high-income earners.

- Unpredictable federal policies

- Uncertainty regarding tariffs and immigration, as well as their impact on inflation, the labor market, investment, and overall demand.

Budgets are forecasts by humans, and humans can disagree. The Governor’s proposed budget anticipates a $2.9 billion shortfall in 2026-27. The state Legislative Analyst (LAO), in contrast, sees an almost $18 billion shortfall. The difference is even greater in future years. See chart below:

The LAO reports that, while the Governor’s budget proposes about $5 billion in spending solutions on an ongoing basis, “these fall well short of the amount needed to substantially address future deficits”.

Warning! The proposed budget could change in May

In 2024-25 the budget process was disrupted and delayed by wildfires, leading to flawed revenue predictions and unanticipated cuts. If other disasters lead to another delay in tax filing, the problem could be repeated.

State budget basics: the General Fund

California operates on a fiscal year that begins in July (matching the school year). Under public scrutiny, the Governor’s January proposal is formally revised each year in May. A budget bill must be passed by the legislature and signed by the Governor by June 30.

The table below looks at how money is spent in the proposed 2026-27 state budget, compared to last year.

Quiz: Is funding for corrections (prisons) larger than funding for education?

No! Education is a MUCH bigger function of government than corrections. Prisons are very expensive, but happily there are far more students than prisoners! (Easy one, right?)

How is the education share of the state budget determined?

California’s constitution requires about 40% of the state General Fund to be directed to public TK-12 schools and community colleges. In combination with local property taxes for education, this is called the Prop 98 budget. This funding is based on attendance, not enrollment.

The formula for how much of the General Fund goes to education includes many factors, including how well the economy is doing, whether there are more or fewer kids showing up to public school, and changes in the cost of living. The chart below adjusts for inflation.

You can see that the Prop 98 amount in red for 2026-27, after adjusting for inflation, is slightly higher than in the previous three years. But it is significantly higher than earlier budgets.

Local Control Funding Formula

The rules that allocate funds from Prop. 98 to school districts are known as the Local Control Funding Formula (LCFF). Money is allocated from the state general fund and from property taxes based on the number of students who show up to school and the characteristics of those students.

The formula directs more money to districts to support students who are low income, in foster care, homeless, and/or learning English.

Here is how it works in virtually all districts:

- Base Funding: Districts receive a base grant for each student who comes to school. The base grant is larger for grades 9-12 than for other grade levels.

- Supplemental Funding: Districts receive 20% additional funding per student for students with high needs — specifically defined as learning English, in low income, homeless, or in foster care.

- Concentration Funding: Districts are provided additional money if more than 55% of children in the district qualify as having high needs.

- Equity multiplier: Beginning in 2023-24, the state added the option of providing additional funding in support of high-need school sites where more than 70% of the student population is socioeconomically disadvantaged.

School districts then allocate money to pay for staff and programs in individual schools. Some of the money from the state also pays for targeted categorical needs such as Special Education and Arts Education.

Quiz: Do all schools receive the same amount of money? Explain.

Well, it’s a little complicated, which is why Ed100 exists. To understand how and why funding for schools varies, we invite you to read Ed100 Chapter 8, our very best effort to explain it. School districts only receive money for students who show up, and they receive some additional funding to the extent that their students have certain kinds of needs.

In addition to local property tax funds, most schools receive financial support from state and federal sources. Ed100 Chapter 8 demystifies California's school finance system, including the weird stuff.

|

Education funding by the numbers, 2026-27 Governor's Budget |

|

|---|---|

|

TK-12 funding per pupil (Prop 98) |

$20,427 Proposition 98 General Fund and $27,418 when the contribution of all sources including local property taxes and federal programs are included. [Budget summary page 17] Note: California is one of the few states that bases its funding per pupil calculation on attendance. Most states use enrollment. This difference in definition regularly leads to confusion about funding per student. |

|

LCFF cost-of-living adjustment (COLA) |

2.41% increase. When adjusted for enrollment growth, this will result in an increase of roughly $2 billion in discretionary funds for school districts, charter schools and county offices of education. (Link) Note: The costs of healthcare and special education have risen faster than the COLA. This is one reason so many school districts are struggling to make ends meet. (See historical rates.) In addition, the COLA does not reflect the real costs of running a school district. |

|

Prop. 98 Guarantee for TK-12 schools and community college (link) |

$125.5 billion in 2026-27 The Guarantee for TK-12 schools and community colleges is calculated to be $123.8 billion in 2024-25, $121.4 billion in 2025-26, and $125.5 billion in 2026-27. These revised Proposition 98 levels represent an increase of approximately $21.7 billion over the three-year period relative to the 2025 Budget Act. A contentious issue: Additionally, due to persistent uncertainty in revenue projections, the Budget proposes creating $5.6 billion in settle-up in 2025-26. This means that the funded level of the Guarantee in 2025-26 is $115.9 billion, instead of the calculated amount of $121.4 billion. According to reporting by EdSource, some school advocates argue that this money should not be withheld. The Governor says “This is intended to mitigate the risk of potentially appropriating more resources to the Guarantee than are ultimately available in the final calculation for 2025-26. Potential adjustments will be made at the May Revision and will not be final until the certification of the 2025-26 Guarantee level in spring 2027.” The Guarantee continues to be in a Test 1 for 2024-25, 2025-26, and 2026-27. |

|

Rainy Day Fund triggers cap in school district reserves |

The Budget Stabilization balance in 2026-27 is $14.4 billion—an increase compared to the 2025 Budget Act level of $11.2 billion. In addition to this reserve amount, the Budget includes $4.5 billion in the Special Fund for Economic Uncertainties and $4.1 billion in the Public School System Stabilization Account—bringing the combined amount of reserves in 2026-27 to roughly $23 billion. “Under current law, there is a cap of 10 percent on school district reserves in fiscal years immediately succeeding those in which the balance in the Proposition 98 Rainy Day Fund is equal to or greater than 3 percent of the total TK-12 share of the Proposition 98 Guarantee. The balance in the Proposition 98 Rainy Day Fund in all years of the three-year budget window triggers school district reserve caps in 2025-26 and 2026-27.” |

State education governance

In tandem with the budget process, the governor proposes to amend the Education Code to move oversight authority of the management of the California Department of Education and support of school districts under the State Board of Education (SBE). It’s an idea with a long history, as John Fensterwald explains in EdSource. The fuzzy lines of authority between the SBE and the state Superintendent of Public Instruction have at times led to colliding policies.

Which programs are funded in the education budget?

In addition to the flexible money that is distributed to school districts under LCFF, the budget also funds specific programs that reflect significant priorities of the Governor and the legislature.

The table below lists some of them.

|

Educational priorities in the California 2026-27 budget |

|

|---|---|

|

Community Schools |

$1 billion from Proposition 98 General Fund to expand the community school model to more school sites that have large concentrations of students from low-income families, English learners, and youth in foster care. “To date, the state has invested $4.1 billion one-time Proposition 98 General Fund in community schools and achieved full deployment of planning and implementation grants to support nearly 2,500 schools (1 in every 4 schools in the state) in adopting the community schools model.” |

|

Special education |

Increase of $509 million ongoing Proposition 98 General Fund to increase special education base rates. This additional funding will allow for full equalization of special education rates across the state, meaning that all districts and charter schools will now receive the same rate per pupil for state special education funding. |

|

Before School, After School, and Summer School |

$62.4 million of ongoing Proposition 98 General Fund to provide a guaranteed $1,800 per pupil for LEAs with TK-6th grade with less than 55 percent high-need pupils, stabilizing the existing variable rate. With this increase, total ongoing program funding is $4.7 billion from the Proposition 98 General Fund. |

|

Master Plan for Career Education: TK-12 Education |

$100 million one-time Proposition 98 General Fund to increase access to college and career pathways for high school students, including expanding access to dual enrollment and dual credit opportunities. Prioritizes creation and expansion of dual enrolment and pathways programs with funds allocated through the $2.8 billion Student Support and Discretionary Block Grant. |

|

Home-to-School Transportation |

$322 million one-time and $239.2 million of ongoing Proposition 98 General Fund to reflect higher costs in the Home-to-School Transportation Program. |

|

Teacher Preparation and Professional Development |

$250 million one-time Proposition 98 General Fund to continue educator residency programs through 2029-30. California has invested $620 million in residency programs over the last five years; these funds will be fully awarded by the end of 2025-26. |

|

Student Support and Professional Development |

$2.8 billion one-time Proposition 98 General Fund for a discretionary block grant. These funds will provide districts and charter schools with additional fiscal support to manage declining attendance and enrollment, including those caused by federal government immigration actions, and address rising costs. The funds will also support implementation of statewide priorities: (1) professional development for teachers on the English Language Arts/English Language Development (ELA/ELD) Framework and the Literacy Roadmap, with a focus on strategies to support literacy for English learners; (2) professional development for teachers on the Mathematics Framework; (3) teacher recruitment and retention strategies; (4) professional development for TK teachers and site administrators on the principles and guidelines of developmentally appropriate TK instruction; (5) career pathways and dual enrollment expansion efforts consistent with the Master Plan for Career Education. |

|

School Facility Program |

The K-12 Schools and Local Community College Public Education Facilities Modernization, Repair, and Safety Bond Act of 2024 (Proposition 2) authorizes a total of $8.5 billion in state General Obligation bonds for TK‑12 schools to be allocated through the School Facility Program. These funds are allocated across several key areas: • $4 billion for modernization projects, • $3.3 billion for new construction, • $600 million for charter schools, and • $600 million for career technical education projects. The Budget continues to allocate $1.5 billion of bond funds from 2024 Proposition 2 to support school construction projects in 2026-27, similar to amounts allocated in prior years. |

|

Learning Recovery Emergency Block Grant |

$757.3 million one-time Proposition 98 General Fund to support the Learning Recovery Emergency Block Grant, which provides funds to districts and charter schools to establish learning recovery initiatives through the 2027-28 school year. This is expected to be the final payment to this program, which has received multi-year investments totaling $7.2 billion for learning recovery efforts related to the COVID-19 Pandemic. |

|

Cost-of-Living Adjustments (COLA) |

$228.2 million of ongoing Proposition 98 General Fund to reflect a 2.41% cost-of-living adjustment. |

|

Kitchen Infrastructure and Training |

$100 million one-time Proposition 98 General Fund for specialized kitchen equipment, infrastructure, and training to support schools in providing more freshly prepared meals made with locally grown ingredients. |

|

Reading Difficulties Risk Screening |

$40 million one-time Proposition 98 General Fund to support continued implementation of student reading difficulties screenings. |

|

L.A. County School Wildfire Recovery |

$22.9 million one-time Proposition 98 General Fund to support districts and charter schools that are continuing to recover from the January 2025 wildfires in Los Angeles County. |

|

Universal and Targeted Assistance |

$13.3 million additional ongoing Proposition 98 General Fund, for a total of $131.9 million, for county offices of education to provide support to school districts and charter schools. |

|

FCMAT |

$994,000 in additional ongoing Proposition 98 General Fund to support increased workload for the state’s Fiscal Crisis and Management Assistance Team, which prevents financial disasters in California’s school system. |

|

California School Information System (CSIS) |

$966,000 in additional ongoing Proposition 98 General Fund to support increased costs in the California School Information System (CSIS). |

|

Curriculum Embedded Performance Tasks for Science |

$890,000 ongoing Proposition 98 General Fund to maintain performance task resources at the Los Angeles County Office of Education in support of inquiry-based science instruction and the state’s Next Generation Science Standards. |

|

K-12 High Speed Network |

$629,000 in additional ongoing Proposition 98 General Fund to support the K-12 High Speed Network program. |

|

County Offices of Education LCFF |

An ongoing decrease of $15.6 million from the Proposition 98 General Fund to county offices of education to reflect ADA changes applicable to the LCFF, and a 2.41-percent cost-of-living adjustment. |

|

School Nutrition Programs |

An ongoing decrease of $67.9 million Proposition 98 General Fund to support the Universal School Meals program, reflecting a reduction in 2025-26 estimates compared to the 2025 Budget Act projections and an increase in meal reimbursement rates. |

|

Local Property Tax Adjustments |

A decrease of $18 million Proposition 98 General Fund for school districts and county offices of education in 2025-26, and a decrease of $1.4 billion ongoing Proposition 98 General Fund for school districts and county offices of education in 2026-27, resulting from increased offsetting property taxes. |

|

Holocaust and Genocide Education Grant Program |

The Administration intends to propose up to $10 million at the May Revision in one-time grants to districts and charter schools for instructional materials, professional development, and related costs to implement holocaust and genocide education pursuant to Chapter 761, Statutes of 2025 (SB 472). The proposed Proposition 98 General Fund funds are contingent upon clean-up amendments to the statutory language, agreed to by both the Administration and Legislature. |

The budget process ahead

Throughout the first half of the calendar year, committee hearings examine both the budget itself and education bills that might have an impact on the budget. Each of these pathways is a little different. (The California Budget & Policy Center, a non-profit organization, does a great job of explaining the distinction between these two paths.)

Going to the source...

- California 2026-27 proposed budget

- Department of Finance presentation and YouTube video

- California multi-year budget projection summary

- LAO budget overview

- LAO Fiscal Outlook for Schools and Community Colleges

As always, EdSource provides excellent coverage of California's education policy developments. If you've reached the end of this post and want more, follow EdSource.

Tags on this post

All Tags

A-G requirements Absences Accountability Accreditation Achievement gap Administrators After school Algebra API Arts Assessment At-risk students Attendance Beacon links Bilingual education Bonds Brain Brown Act Budgets Bullying Burbank Business Career Carol Dweck Categorical funds Catholic schools Certification CHAMP Change Character Education Chart Charter schools Civics Class size CMOs Collective bargaining College Common core Community schools Contest Continuous Improvement Cost of education Counselors Creativity Crossword CSBA CTA Dashboard Data Dialogue District boundaries Districts Diversity Drawing DREAM Act Dyslexia EACH Early childhood Economic growth EdPrezi EdSource EdTech Education foundations Effort Election English learners Equity ESSA Ethnic studies Ethnic studies Evaluation rubric Expanded Learning Facilities Fake News Federal Federal policy Funding Gifted Graduation rates Grit Health Help Wanted History Home schools Homeless students Homework Hours of opportunity Humanities Independence Day Indignation Infrastructure Initiatives International Jargon Khan Academy Kindergarten LCAP LCFF Leaderboard Leadership Learning Litigation Lobbyists Local control Local funding Local governance Lottery Magnet schools Map Math Media Mental Health Mindfulness Mindset Myth Myths NAEP National comparisons NCLB Nutrition Pandemic Parcel taxes Parent Engagement Parent Leader Guide Parents peanut butter Pedagogy Pensions personalized Philanthropy PISA Planning Policy Politics population Poverty Preschool Prezi Private schools Prize Project-based learning Prop 13 Prop 98 Property taxes PTA Purpose of education puzzle Quality Race Rating Schools Reading Recruiting teachers Reform Religious education Religious schools Research Retaining teachers Rigor School board School choice School Climate School Closures Science Serrano vs Priest Sex Ed Site Map Sleep Social-emotional learning Song Special ed Spending SPSA Standards Strike STRS Student motivation Student voice Success Suicide Summer Superintendent Suspensions Talent Teacher pay Teacher shortage Teachers Technology Technology in education Template Test scores Tests Time in school Time on task Trump Undocumented Unions Universal education Vaccination Values Vaping Video Volunteering Volunteers Vote Vouchers Winners Year in ReviewSharing is caring!

Password Reset

Search all lesson and blog content here.

Login with Email

We will send your Login Link to your email

address. Click on the link and you will be

logged into Ed100. No more passwords to

remember!

Questions & Comments

To comment or reply, please sign in .