Presupuesto de educación casualidad

A billion here, a billion there. What does it mean?

If you unexpectedly received a huge bundle of cash in the state budget, what would be the best way to spend it? This year, Governor Newsom and the legislature are in the enviable position of having to answer that question.

What a difference a year makes, right? Last year, schools struggled to pay for COVID-related costs as the state faced a $54 billion budget deficit.

The $100 Billion California Comeback Plan

This year, many people struggled to make ends meet, but the stock market soared. Those who had wealth found themselves with even more of it. Taxes on capital gains fueled an unexpected boom in tax revenue, delivering a projected budget surplus of $75.7 billion. An additional $25 billion in federal help brings the total windfall to more than $100 billion.

The Governor calls his budget response The $100 billion California Comeback Plan.

“[It's a] once-in-a-lifetime opportunity to not only speed the state's recovery from the pandemic, but to address long-standing challenges and provide opportunity for every California family—regardless of their income, race, or ZIP code.” — Gavin Newsom

What works?

In a long-term study of worldwide education systems, the OECD PISA program has identified a set of key components associated with long-term success. They include:

- Investing in high quality teachers and school leaders.

- Additional resources to support at risk students and low performing schools.

- Early education, after school support, health and counselors.

- On-going analysis of what works and what needs to be improved--focusing on high needs students.

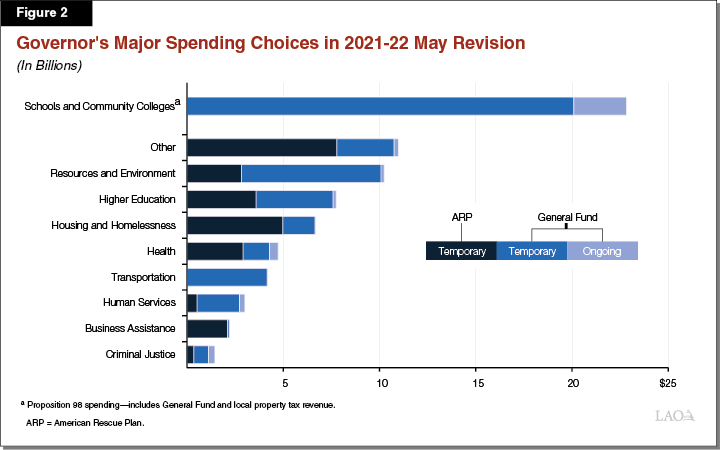

The Governor’s revised education budget proposal reflects a lot of these ideas — investing more funds to support at-risk students and expanded learning as well as support for teachers. The May budget proposal envisions a five-year investment strategy that addresses equity gaps.

To improve education, address poverty

Just looking at how money is invested in education is a bit short-sighted because of the strong link between income and how well children do in school. Investments in health and human services, housing and homelessness and even criminal justice affect education. The proposed state budget and federal funding make strong investments in those areas to help close both opportunity gaps and achievement gaps.

For example, according to an analysis by the Public Policy Institute of California, the planned expansion of the federal Child Tax Credit (CTC) could cut child poverty by a third, from 18.8% to 12.8%, and cut the deep poverty rate by half, from 4.1% to 2.1.

Below are quick summaries of both the California proposed education budget and the enacted under federal American Rescue Plan.

|

California Education Budget 2021-22 by the numbers |

|

|---|---|

|

Funding Topic |

Amount |

|

California per-pupil funding under Prop. 98 Ed100 Lesson: Money for Schools |

Per pupil:$13,977 in 2021-22 $10,654 in 2020-21 (last year) |

|

LCFF funding The proposed budget increases the LCFF concentration rate factor from 50 percent to 65 percent, providing approximately $1.1 billion in ongoing funds for the Proposition 98 General Fund. It requires that the increase in funding be used for additional certificated and classified staff on school campuses. Ed100 lesson: |

Cost of Living Adjustment (COLA) The budget includes an adjustment of 5.07 per cent. Total cost of $66.2 billion |

|

School Reopening This funding is for health and safety needs in schools, to facilitate in-person instruction, including testing, vaccine activities, and cleaning, over a two year period. This funding would be in addition to the $2 billion that school districts received in state funding to reopen this spring.. |

$2 billion in one-time Proposition 98 funding, |

|

Expanded Learning Full-year instruction and enrichment for all elementary school students in local educational agencies with the highest concentrations of low-income students, English language learners, and youth in foster care By 2025-26, these students would have access to no-cost after school and summer programs. Ed100 blogs: |

$1 billion in 2021-22 Grows to $5 billion in 2025-26. |

|

Community Schools This would support grants for up to 1,400 local educational agencies (more than 60 percent of local educational agencies statewide) to convert school campuses into full-service community schools. Ed100 blog: Community schools |

$3 billion One-time Proposition 98 General Fund, available over several years |

|

Increase services eg counselors, nurses, teachers, paraprofessionals Ed100 lessons: |

$1.1 billion Ongoing increase to the LCFF concentration grant |

|

Intensive tutoring and support Funds to schools to provide research-tested interventions for students, including intensive tutoring. Ed100 lesson: Extra time and Tutoring |

$2 billion one-time federal funds $623 million one-time state Proposition 98 funds |

|

Children and Youth Behavioral Health Initiative |

$400 million increase |

|

Mental Health Behavioral Health Systems Ed100 lesson: Health and Learning |

$1 billion from the federal American Rescue Plan Act's Coronavirus State Fiscal Recovery Fund (ARPA) in 2021-22 $1.7 billion ($1.3 billion ARPA, $300 million General Fund, and $100 million Federal Trust Fund) in 2022-23 $431 million ($300 million General Fund) ongoing for the Children and Youth Behavioral Health Initiative. |

|

Foster Youth Funding to support work with local partners to coordinate and provide direct services to these students. Ed100 lesson: Foster Youth |

$30 million One-time Proposition 98 funds |

|

Educator Retention, Preparation and Training Ed100 lesson: Teachers |

$3.3 billion |

|

Nutrition Expand school meals/ staff training and support/Farm to School Initiative Ed100 blog: |

$280 million |

|

Special Education Ed100 lesson: |

$277.7 million one-time federal $117.7 million Proposition 98 General Fund $15 million one-time federal IDEA to address impact of pandemic $2.3 million federal IDEA funds to address complaints $1.2 million federal to increase access to inclusive settings |

|

Broadband: Close Digital Divide Ed100 blog: |

About $7 billion in combined state and federal funds. |

|

Child Savings Accounts for low income students |

$2 billion one-time federal funds $170 million state funds beginning in 2022 $500 per account in seed funds |

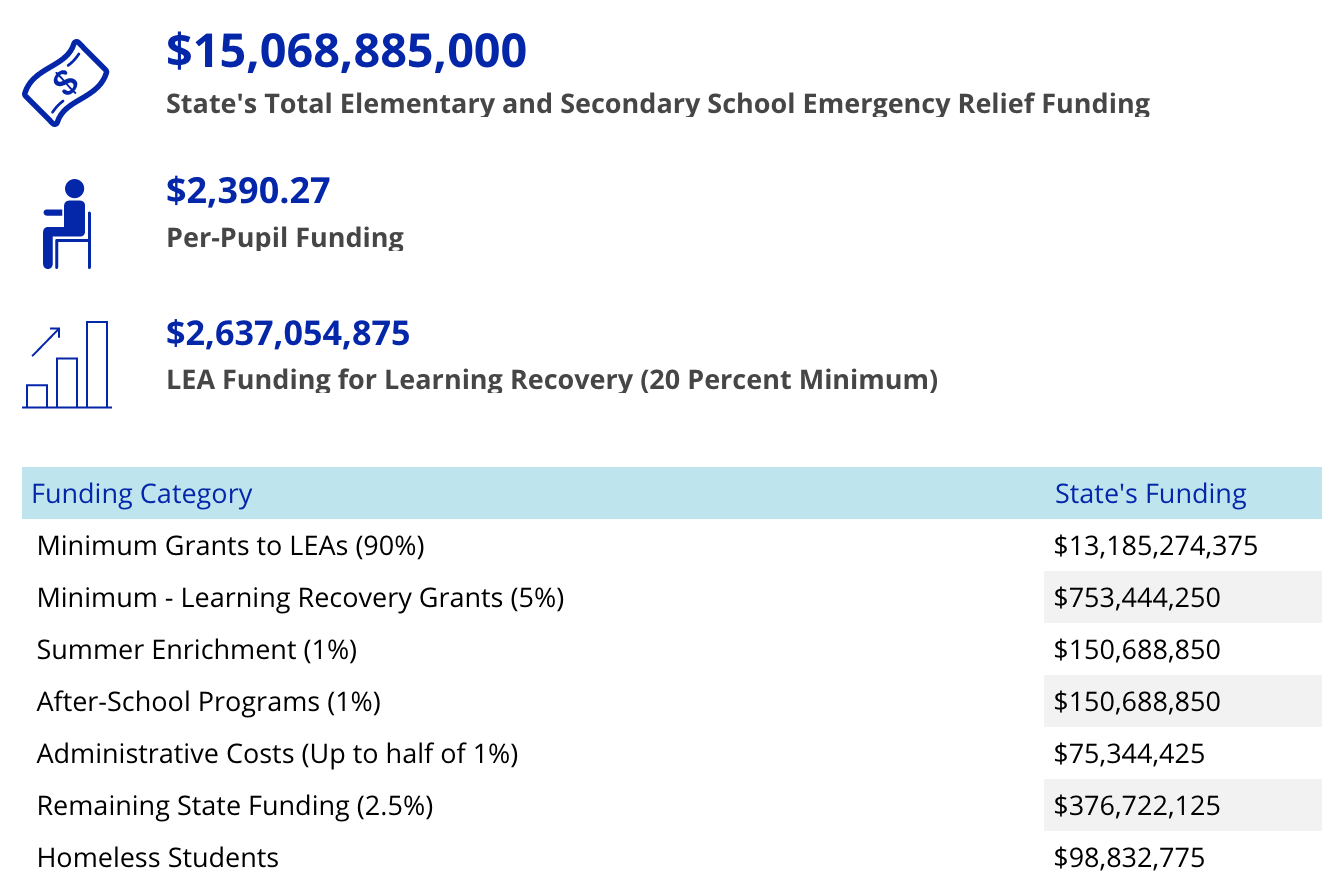

Federal help for schools

In addition to the substantial state funds for education, the federal government is also providing significant support. The Learning Policy Institute provides a state by state breakdown of extra federal help for education. Here is what California is expected to receive:

The Legislative Analyst's first take on the proposal

The California Legislative Analyst (LAO) is an independent office of the government that provides professional advice to the legislature and policy makers. In this case, the LAO cautions that a large portion of the $75 million surplus comes with strings attached. It comes to a different amount of surplus to allocate: $38 billion.

It also suggests:

- Leave more money in reserves to respond to future challenges.

- Withhold some decisions so there is more time to consider changes.

Next Steps

After the Governor’s revised budget is presented, the legislature has a brief chance to give input on what the final budget will look like.

In the coming weeks, expect:

- Extensive discussions about how to provide quality distance learning

- Policy questions as to whether more of the money should be left to local control.

- Extensive line-by-line review of each proposal to see how it works in practice.

- Discussion of what needs to be done now and what can be delayed.

By June 15, the Senate and Assembly leaders will huddle with the Governor to hash out the final details and pass a balanced budget by a majority vote of both houses. If the process gets stuck and they don't pass a budget on time, legislators are not paid, based on an initiative passed in 2010 after a series of budget delays.

On July 1, the state begins the new fiscal year. Between the passage of the budget by the legislature and July 1 the Governor may cut specific expenditures using line-item vetos. This is rare. In 2020 it was used once.

Etiquetas de esta publicación

Presupuestos PandemiaTodas las etiquetas

Academia Khan Acoso acreditación Actitud Administradores Agallas Álgebra Ambiente escolar Aprendizaje Aprendizaje Ampliado Aprendizaje basado en proyectos Aprendizaje socioemocional Artes Asistencia Asociación de Maestros de California Asociación de Padres y Maestros Atención plena Ausencias Bonos de obligación Brecha de desempeño Burbank Calidad Calificación de escuelas Calificaciones en pruebas Cambio Canción Carol Dweck Carrera Cerebro Certificación CHAMP Ciencia Cierre de escuelas Civismo Comparaciones nacionales Concurso Consejeros Consejo escolar Control local Costo de educación Creatividad Crecimiento económico Crucigrama CSBA Currículo común cursos de estudios étnicos Datos Después de clases Día de la Independencia Diálogo dislexia Distritos Diversidad Dotado DREAM Act EACH EdPrezi EdSource EdTech Educación bilingue Educación del carácter Educación especial Educación religiosa Educación sexual Educación universal Elección Elección de escuela Enlaces guía Equidad Escasez de maestros Escuelas católicas Escuelas chárter Escuelas comunitarias Escuelas en casa Escuelas Magnet Escuelas privadas Escuelas religiosas Esfuerzo Estándares Estudiantes en riesgo Estudiantes que están aprendiendo inglés estudiantes sin hogar Estudios étnicos Evaluación Evaluación nacional de progreso educativo Éxito Federal Filantropía Financiamiento Financiamiento local Fondos por categorías Fundaciones educativas Ganadores Gastos Gobierno local Gráfica Grupos de presión Guía para padres líderes Historia Horas de oportunidad Huelga Humanidades Impuestos a la propiedad Impuestos prediales Índice de desempeño académico Indignación Indocumentado Infraestructura Iniciativas Instalaciones Internacional Investigación Jerga Kindergarten La Ley Brown LCFF Lectura Ley Cada Estudiante Triunfa Ley Que Ningún Niño Se Quede Atrás Liderazgo Límites de distritos Litigación Lotería Maestros mantequilla de cacahuate Mapa Mapa del sitio Marcador Matemáticas Medios de comunicación Mejoramiento Continua Mito Mitos Motivación estudiantil Negociación colectiva Negocio Niñez temprana Noticias falsas Nutrición Organizaciones de gestión para escuelas chárter Padres Pandemia Participación de los padres Pedagogía Pensiones personalizado PISA Plan de responsabilidad de control local Planificación Plantilla Población Pobreza Política Política federal Políticas Premio Prescolar Presupuestos Prezi Proposición 13 Proposición 98 Propósito de la educación Pruebas Reclutamiento de maestros Reforma Requisitos ag Responsabilidad Resumen del año Retención de maestros Rigor rompecabezas Rúbrica de evaluación Salario de maestros Salud Salud mental Se necesita ayuda Serrano vs Priest Sindicatos Sorteo SPSA STRS Sueño Suicidio Superintendente Suspensiones Tablero Talento Tamaño de clases Tareas escolares Tasas de graduación Tecnología Tecnología en la educación Tiempo dedicado a la tarea Tiempo en la escuela Trump Universidad Vacunación Vales Valores Vapeando Verano Vídeo Voluntariado Voluntarios Voto Voz del estudiante¡Compartir es vivir!

Restablecer contraseña

Buscar aquí en el contenido del blog y todas las lecciones.

Iniciar sesión con correo electrónico

We will send your Login Link to your email

address. Click on the link and you will be

logged into Ed100. No more passwords to

remember!

Preguntas y comentarios

Para comentar o responder, por favor inicie sesión .